Q1 2019 Reports: How’s the Market?

Be forewarned, this quarter’s report looks somewhat dismal. There are two very relevant facts that should be taken into consideration when reviewing it. The first is that Q1 is nearly always the worst performing quarter of any year because the sales completed in Q1 typically went under contract between late November and the end of February—a notably quieter time of year in our seasonal Seattle market.

The second aspect to consider is that Q1 of 2018 was an atypically strong quarter and likely marked the peak of the current real estate cycle as buyers approach this year’s spring market with cautious optimism rather than the reckless abandon that we witnessed in the first four months of last year.

Since then, mortgage interest rates rose in November to a seven-year high of 4.87% and then subsequently came down to 4.27% in March—creating enough of a stir to get buyers attention. Each 1% increase in mortgage interest rate is equivalent to a 10% increase in home price. Conversely, a half point drop in the rate is comparable to a 5% price reduction.

Sellers and buyers are beginning the second quarter on more equal footing than they’ve had since the late 1990’s as we’ve rapidly oscillated between a seller’s market, a buyer’s market, and then a seller’s market again with little breathing room in between. Sellers have enjoyed a seven-year run with double digit annual appreciation most of those years. Buyers have enjoyed record setting low interest rates and can purchase today at what amounts to roughly 60% of the monthly expense of the forty-seven-year average 8.09% mortgage interest rate.

The market has much to offer buyers and sellers this year. We believe those looking to make a move in the next few years should do so this year when they can still secure incredibly affordable mortgage financing. Today’s buyers should be prepared to stay in their home at least five years. Home sellers moving to lower cost regions may also benefit from selling now. We know that every situation is unique, and we are here to help you evaluate your personal real estate holdings and purchase strategy.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

The number of homes for sale more than doubled in Q1 compared to one year ago giving buyers options and compelling sellers to put their best foot forward. Seattle’s overall Median Sale Price was down 5.8% from Q1 2018 to $725,000 and down 1.4% from Q4. The Average $ Per Square Foot was down 1.6% from Q1 last year to $422. Queen Anne-Magnolia and North Seattle were the most impacted markets with the largest decrease in median price. As disappointing as the numbers are, Seattle homeowners have seen a 60% increase in the Median Sale Price over the past five years.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

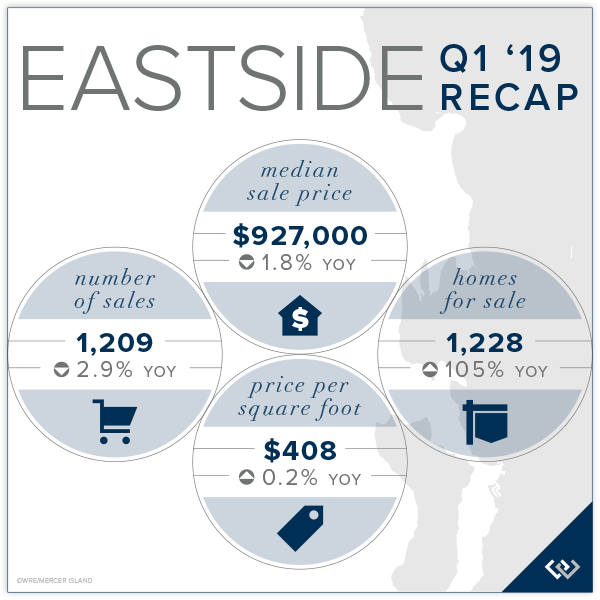

EASTSIDE

Continued employment growth and planned expansion on the Eastside have benefitted homeowners as compared to Seattle as Bellevue, Redmond and Kirkland prepare for unprecedented development in the next decade. The Eastside’s Median Sale Price was down 1.8% from Q1 2018 to $927,000, but up 3.9% from Q4. The five-year Eastside median price trend is up 53% over 2014.

East Bellevue, East of Lake Sammamish, and Woodinville performed best in Q1—all with median price increases rather than reductions. A total of 1,209 home sales closed in Q1, which was down significantly from Q4, but down only slightly from the robust Q1 2018.

Click here for the full report and neighborhood-by-neighborhood statistics!

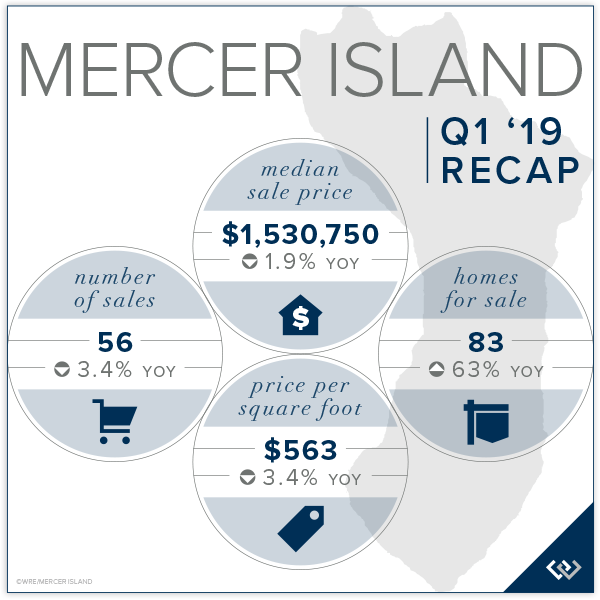

MERCER ISLAND

Following a 10% Median Sale Price increase in 2018, the Mercer Island median fell 1.9% in Q1 2019 from Q1 2018 and 10.9% from Q4. Fewer luxury sales—only one waterfront sold in Q1—and lower demand contributed to the off quarter. The lower velocity of luxury sales impacted the Average Sale Price even more so than Realistically priced homes in solid condition and with desirable lot amenities and settings will do well in Q2 as they are met with demand from the greatest segment of buyers.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

CONDOS – SEATTLE & EASTSIDE

Affordability and access to transportation and amenities continues to drive condo desirability, but a nearly three-fold increase in the number of units for sale and softening apartment rents have tempered demand in some areas.

Seattle’s Condo Median Sale Price was down 4% from Q4 and 10.7% from Q1 2018 to $460,000 following a 12.8% median price increase in 2018. The Average $ Per Square Foot was $577. West Seattle and Queen Anne condos fared better than average while condos prices to the north softened a bit more.

The Eastside’s Condo Median Sale Price was down 5.5% from Q4 and 4.2% from Q1 2018 to $460,000—the same as Seattle—following a 17.2% median price increase in 2018 and a 20.6% increase in 2017. The Average $ Per Square Foot was $431. South Eastside and Mercer Island condos performed better than average while Kirkland condos struggled in Q1.

Check out all of these factoids and more in the full condo report.

WATERFRONT

The Eastside had more private waterfront activity than Seattle, Mercer Island & Lake Sammamish combined. Seattle and Mercer Island sales were far slower than typical in Q1 with only two sales in Seattle and one sale on Mercer Island reported to NWMLS. Mercer Island had eight Q1 sales in 2017 and five in 2018. Seattle had six Q1 sales in 2017 and 3 in 2018.

The highest Q1 sale was a 1963 Yarrow Point home on 80 feet of waterfront sold at $8,650,000 after only 5 days on the market. The lowest sale was a 1940 Pleasure Point bungalow in South Bellevue with 45 feet of waterfront for $1,560,000 on the market for 7 days. Waterfront homes sold in Q1 tended to either sell immediately or languish on the market for months with very few finding middle ground.

This top-level overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, provides a glance into the trends occurring in our region over time. Interesting, and certainly insightful, it in no way replaces an in-depth analysis on waterfront value provided by a savvy broker with years of local waterfront experience.

Check out the full Waterfront Report for a complete list of waterfront home sales by address and community.

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2019, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

Annual Seattle-Eastside Real Estate Report: A Look Back at 2018

An increase in homes for sale coupled with rising interest rates have created a far more balanced market than we started 2018 with. This is a good thing as it will help our region tame affordability and create a sustainable marketplace. More homes came to market in 2018 than in any year since 2011. This provided home buyers with plentiful choices and forced home sellers to competitively position their homes to compete with other homes for sale—something they haven’t had to give much thought to in the last seven years.

The cost of a 30-year fixed-rate mortgage began the year at 3.95% and ended at 4.64%. Indications show rates could rise to 6% by the end of 2019. Mortgage rates are a far bigger factor than most people consider. A 1% increase in mortgage interest rates decreases buying power by 10%. Or said differently, a 1% rate increase has the same net effect on monthly payment as a 10% increase in the sale price. That also means if prices fell 10% but rates went up 1% the monthly mortgage payment would remain the same.

Our 2019 market will be driven by buyers motivated to beat interest rate hikes nipping at their heels and by sellers who will choose to price moderately following a seven-year appreciation growth run. Properly-priced homes in good condition and in desirable settings will do well, as will affordable homes on the periphery of the metro region. Strategic positioning, savvy marketing, and expert negotiation have never been so important as they are now.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

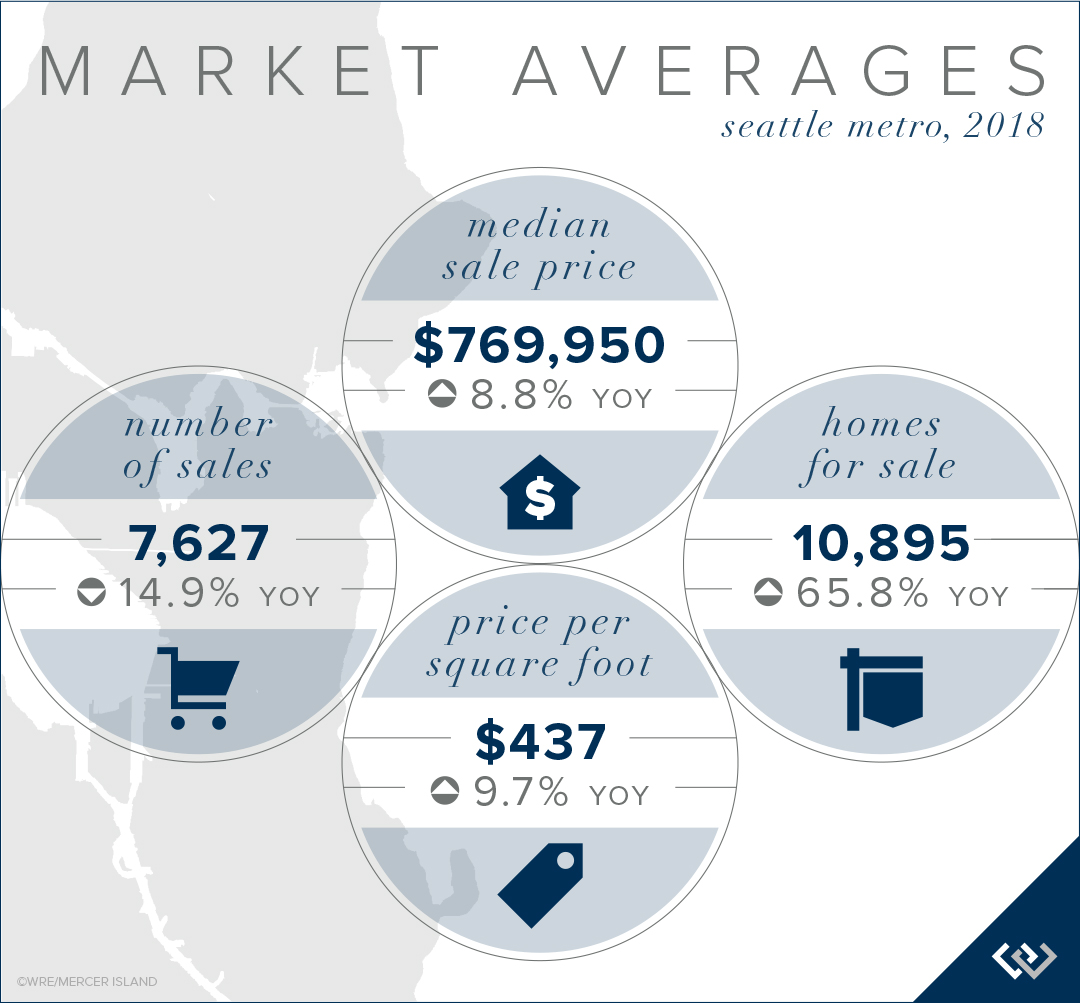

2018 was a year of transition from an ultra-competitive seller’s market to a more balanced market. The first four months of the year saw dramatic price acceleration—arguably far beyond the comfort of Seattle area home buyers—as home values skyrocketed each month through the spring market. Around the beginning of May, home buying activity slowed as the number of homes for sale increased and buyers had more choices for the first time in years. Home prices have declined since that peak in most neighborhoods, but still ended the year up comfortably over 2017 values.

Seattle’s overall Median Sale Price was up 8.8% to $769,950, while its Average Sale Price was up 10.4% to $883,590. The Average $ Per Square Foot increased 9.7% to $437, with Lake Forest Park/Kenmore the most affordable region at $327/sq ft and Madison Park/Capitol Hill the most spendy at $561/sq ft.

Three Seattle neighborhoods had double-digit median price growth in 2018: Lake Forest Park/Kenmore at 14.4%, West Seattle at 12.7%, and Queen Anne/Magnolia at 12.2%.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

EASTSIDE

Even with Eastside expansion announcements from several notable tech companies, 2018 saw a shift from an ultra-competitive seller’s market to a more balanced market. While the sky is not falling, price growth has slowed to a more modest and sustainable pace. After rising astronomically at the beginning of the year, prices have generally softened as buyers and sellers find their new norms.

The Eastside’s overall Median Sale Price was up 8.2% to $939,129, while its Average Sale Price was up 9.3% to $1,143,557. The higher average sale price reflects the impact of luxury home prices at the upper end of the market. The median sale price is attributed to the larger volume of mainstream sales at more moderate price points.

Four Eastside neighborhoods had double-digit median price growth in 2018: Kirkland at 23.8%, Woodinville at 12.9%, West Bellevue at 12.4%, and Mercer Island at 10.0%.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

The Island, much like the region surrounding it, saw a shift from an ultra-competitive seller’s market to a more balanced market as the number of homes for sale increased markedly following a strong spring market. Home values have softened since the peak market of 2018, but still ended the year with a hefty increase over 2017 values.

The number of home sales were down in 2018: 285, as compared to 330 in 2017. Modern, turn-key homes and highly desirable settings were most sought after while those lacking essential attributes were often passed over, ending the year unsold.

Uniquely situated near both the Seattle and Eastside metro areas, the Island has always tended to fare better than most in a transitioning market. Mercer Island’s Median Sale Price was up 10.0% to $1,700,000, while its Average Sale Price was up 10.5% to $2,059,996. The higher average sale price reflects the impact of luxury home prices at the upper end of the market. The Average $ Per Square Foot increased 11.3% to $606.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

CONDOS – SEATTLE & EASTSIDE

New construction added to the more than two-fold increase in the number of condos for sale during the year compared to 2017, from 2,131 to 4,857 units listed throughout the year. Even so, regional affordability issues drove condo desirability to all-time highs and fueled price increases that outpaced single-family homes.

Seattle’s Condo Median Sale Price was up 12.8% to $505,500, while its Average Sale Price was up 10.5% to $582,163. The Average $ Per Square Foot increased 7.5% to $601. Three regions saw increases above 20%: Richmond Beach/Shoreline at 26.8%, Ballard/Green Lake at 24.1%, and South Seattle at 24.0%.

The Eastside’s Condo Median Sale Price was up 17.2% to $480,500, while its Average Sale Price was up 17.0% to $576,061. The Average $ Per Square Foot increased 13.5% to $453. Two regions saw increases above 20%: East Bellevue at 34.0% and Kirkland at 25.0%.

Check out all of these factoids and more in the full condo report.

WATERFRONT

While the number of sales in 2018 was down markedly compared to recent years as a result of fewer international buyer purchases, a handful of notable sales drove value markers up, creating the artificial appearance of appreciation when price growth was relatively flat in 2018. Those sales include three Media and Points properties sold above $14 M, a record Lake Sammamish sale above $11 M, a Mercer Island sale above $13 M, and a Laurelhurst sale at $11 M.

This top-level overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, provides a glance into the trends occurring in our region over time. Interesting, and certainly insightful, it in no way replaces an in-depth analysis on waterfront value provided by a savvy broker with years of local waterfront experience.

Check out the full Waterfront Report for a complete list of waterfront home sales by address and community.

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2019, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

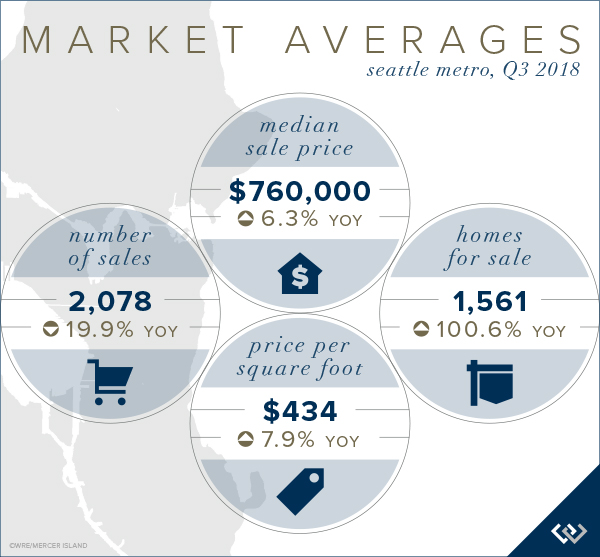

Q3 2018 Seattle-Eastside Real Estate Report

As Q3 comes to a close, 30-year fixed-rate mortgages are at their highest levels since April 2011—now averaging just above 4.7%. Even so, they are still far lower than their 30-year trendline. A 1% increase in mortgage interest rates decreases buying power by 10%. Or said differently, a 1% rate increase has the same net effect on monthly payment as a 10% increase in the sale price. That also means if prices fell 10% but rates went up 1% your payment would remain the same. This is a far bigger factor than most people consider.

Both first-time and move-up home buyers, with (finally!) more homes for sale to choose from and motivated by anticipated further rate hikes nipping at their heels, will feel the urgency to get moved and settled while they can still afford to do so.

Our market is likely to increasingly favor buyers as interest rates cause mortgage payments to increase uncomfortably beyond the affordability ceiling governed by personal income and wages. Properly-priced turn-key homes, and those in the most desirable settings, are still commanding very attractive prices and occasionally multiple offers. Everything else is seeing slowing appreciation and market softening. Strategic positioning, savvy marketing, and expert negotiation have never been so important as they are now.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

Seattle neighborhoods that were strongly bolstered by new construction and renovation saw the strongest sales activity, and not surprisingly, the greatest correlated price growth. Up 16.4% Q3 over Q3, the Queen Anne/Magnolia area led the charge, followed closely by Madison Park/Capitol Hill at 15.9%. Lake Forest Park/Kenmore at 13.2% and West Seattle at 12.5% also fared very well. Richmond Beach/Shoreline (6.2%), Ballard/Green Lake (4%), North Seattle (3.4%), and South Seattle (0.7%) saw notable price easing and contributed to rounding Seattle out to a modest 6.3% overall Q3 2017 to Q3 2018 median price increase.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

EASTSIDE

Sharp increases in the number of homes for sale coupled with fewer international buyer transactions has caused a few ripples in the Eastside real estate market.

Mercer Island shows the strongest Q3 over Q3 increase in median sale price (see explanation below) at 19.7%, followed by Woodinville at 12.3% and Redmond at 12.2%. Bringing up the mid-section was West Bellevue at 8.0%, East of Lake Sammamish at 7.8%. Lagging the Eastside median increase of 7.3% were Kirkland (6.9%), South Eastside (2.0%), and East Bellevue (1.8%).

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

The Q3 median sale price was 19.7% higher than that of Q3 2017. However, its crucial to note that Q3 of 2017 was an anomaly with many land-value sales transacting at the low end of the price spectrum. The effect was that the median sale price was 10.2% lower than Q1 of that same year. Far fewer moderately priced homes transacted in Q3 of this year.

There were 89 sales in Q3 2017 and of those sales 45 were of homes priced below $1.5 million. Compare that to Q3 of 2018 with 74 sales, of which only 28 were priced below $1.5 million. The differential of sales between the two years was almost entirely composed of entry-level and land value home sales.

To further prove this, we looked at comparable homes sold this year and last (an approach like that of the Case-Schiller index). All things being roughly equal, the median sale price of that subset of homes increased only 9.0% from Q3 2017 to Q3 2018. This number is far more in alignment with what we have truly experienced in our market.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

CONDOS – SEATTLE & EASTSIDE

Significant new construction projects underway or announced have dampened sales of existing condos somewhat, especially where they will directly compete with the new buildings. Neighborhood safety is being weighted more carefully against urban hip now more than ever. In Seattle, median sale prices of existing condos in Downtown Seattle/Belltown (-0.4%), Queen Anne/Magnolia (-4.8%), and North Seattle (-8.0%) have all decreased while surrounding areas have seen very strong to moderate Q3-Q3 increases. This quarter’s top contenders were Richmond Beach-Shoreline (30.3%), Ballard-Green Lake (26%), and West Seattle (25%).

On the Eastside, all areas except South Bellevue (-9.3%) saw considerable increases in the Q3 median sale price. East Bellevue (37.1%), Redmond (19.1%), and Kirkland (17.6%) topped the charts.

Check out all of these factoids and more in the full condo report.

WATERFRONT

The Eastside has been a hotbed of waterfront closed sale activity with as many Q3 sales as Seattle, Mercer Island, and Lake Sammamish combined. The number of active private waterfront listings for sale on the Eastside is down compared to Q3 of both 2015 and 2016, while the listing levels of Seattle, Mercer Island and Lake Sammamish waterfront properties remain about the same.

With only two closed sales in Q3, Months of Inventory—the number of homes for sale divided by the number of homes that sold—climbed dramatically on Mercer Island. Seattle, with four closed waterfront sales, saw a similar but more moderate increase. The Eastside and Lake Sammamish both experienced improvement in the Months of Inventory indicator.

The highest private waterfront Q3 sale was of a newer 6,570 square foot Hunts Point modern estate designed by Baylis Architects with 80 feet of no-bank waterfront on just over an acre of lush, private grounds for $18 million. The lowest sale was a 1,010 square feet westside Lake Sammamish 1958 beach house with 60 feet of waterfront on a shy ¼ acre lot with permitted approval for a new 5000 square foot home.

Check out the full Waterfront Report for a complete list of waterfront home sales by address and community.

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2018, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

Kicks for Kids Shoe Drive Now Through August 15th

WHAT: Windermere’s Kicks for Kids event is a back-to-school sneaker drive for low-income youth, distributed through the Eastside Baby Corner.

WHY: Kids from struggling families are in need of back-to-school shoes that fit. When kids feel good about their appearance, it improves both their self-esteem and their performance in school.

WHEN: Formal shoe collection will take place from August 1st – August 15.

WHERE: Windermere Mercer Island is the collection point where you can drop off new athletic shoes or sneakers (youth sizes 1-6 and adult sizes 7-9) or $20 Payless Shoe Source gift cards.

WHO: Sponsored by Windermere Mercer Island in partnership with the Eastside Baby Corner, located in Issaquah, Washington.

Windermere Mercer Island invites you to help in its back-to-school sneaker drive, known as the Kicks for Kids Shoe Drive, which serves the local communities to connect low-income youth with shoes for the upcoming school year. This year, we’re connecting with the Eastside Baby Corner, which is an amazing organization that helps kids thrive by providing resources and essentials with their 51 partner agencies – 26 of which are access to services through schools. The Eastside Baby Corner partners with charitable organizations throughout the Greater Seattle Area and helps them with the resources they need to best assist local families in need.

Help us make sure every child has a new pair of shoes for school!

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2018, Windermere Real Estate/Mercer Island.

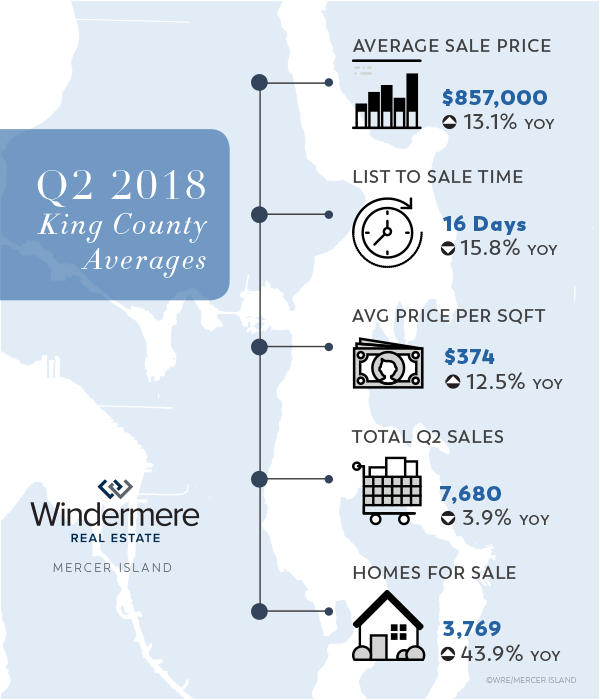

Q2 2018 Seattle-Eastside Real Estate Report

Signs of transition to a more balanced market are becoming abundantly clear as we move further into 2018. Price growth, while still climbing in most areas, has tapered off and average market times are inching up. Brokers are beginning to dust off forms that have seen little use of late—finance and inspection contingencies—as buyers gain a stronger foothold at the negotiating table.

Some homes are still garnering multiple offers and commanding incredible prices and terms, but many more are seeing negotiations more equalized with fewer buyers at the table. Seattle has needed this return to balance for a very long time. It is likely that buyers who were beaten down and bruised over the past couple of years will return to the house hunt, but it will likely be on their own terms. Waiving all contingencies, releasing a substantial earnest money to the seller up front, and giving the seller a period of free possession after closing will be reserved for only the most coveted homes.

On the other hand, being able to conduct thorough due diligence on a prospective home over a comfortable period after offer acceptance is a buyer right that is returning to the picture. It has been a long time since that was even possible in the hottest neighborhoods. So long, it seems almost foreign. Yet that equalization of power is long overdue and needed to stabilize our market.

Overall median Q2 ‘17 to Q2 ‘18 prices in Seattle rose 11.3% to $801,000, while the Eastside rose 9.1% to $960,000. The average cost per home square foot was $459 in Seattle and $426 on the Eastside (which tends to have larger homes—2,752 square feet vs Seattle’s 2015 square feet—and thus a lower cost per square foot to construct).

Home mortgage interest rates have continued to rise, averaging 4.54% in Q2 putting continued pressure on buyers to purchase before they are simply priced out of the Seattle-Eastside market. Our region is entering a sweet spot where home prices are stabilizing and have likely peaked but interest rates are still affordable. Because rising interest rates have a much larger impact on the monthly mortgage than home price, values would have to fall pretty sharply to offset the impact of a 1-2% increase in mortgage interest rates.

SEATTLE

Up 20.7%, affordable Richmond Beach and Shoreline saw the strongest price growth in Q2 followed closely by Lake Forest Park and Kenmore at 19.4%. West Seattle, South Seattle, Madison Park/Capitol Hill, and Queen Anne/Magnolia all saw increases in the mid-teens. Surprisingly, Ballard-Greenlake and North Seattle—strong contenders in the past couple of years—slowed to 11.8% and 6.3% respectively.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

EASTSIDE

Kirkland was the height of the storm on the Eastside drawing a median price gain of 30.6% over Q2 of last year. This was very loosely followed by Juanita/Woodinville at 14.4%, West Bellevue at 14.0%, and Redmond at 11.2%. South Eastside 7.5%, East Bellevue 7.4%, East of Lake Sammamish 6.9%, and Mercer Island 4.5%, all below the Eastside median, represented the fringe of Q2 appreciation.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

Mercer Island, with only two homes priced below $1 million, struggles with the lack of affordability at mainstream price points. While the number of $1-2 million homes for sale is up sharply (46%), finally giving buyers more options to choose from, the pace of sales in that price point has cooled off as buyers wait for the perfect home. A glut of homes for sale in the $3-5 million range—up 67% over this time last year—has caused that segment of the market to stagnate. Homes in the $2-3 million and $5 million plus ranges have fared slightly better than their middle sibling. Mercer Island condos, the only affordable option on the Island, have soared in value with recent sale prices creating shock waves within the industry.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

CONDOS – SEATTLE & EASTSIDE

The number of Seattle metro condos for sale has steadily climbed in Q2 while those available in downtown Bellevue have diminished. Condo prices have continued to outpace their residential counterparts as demand to affordably own vs rent at astronomical prices drives buyer interest. Seattle condos appreciated 20.4-34.6% in all but two markets, North Seattle up 5.6% and SODO/Beacon Hill down 4.5%. On the Eastside, condos were up 13.3-35.2% except for Kirkland up 8.2% and West Bellevue down 3.5%. Not included in these numbers are the newly underway Bosa 188 condos which have a significant number of pending sales that will not close until 2020.

Check out all of these factoids and more in the full condo report.

WATERFRONT

Seattle and Mercer Island have fewer waterfront homes for sale in Q2 this year than in either of the past two years. The Eastside is up very slightly while Lake Sammamish has more than three-fold the number of homes for sale over the same time. The highest closed sale in Q2 was a NW-facing 1937 Yarrow Point estate on 100 feet of waterfront and just over an acre of land for $10 million. The most affordable waterfront sale was a Ripley Lane 2003-built home with 140 feet of waterfront for just shy of $1.7 million.

Check out the full Waterfront Report for a complete list of waterfront home sales by address and community.

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2018, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.

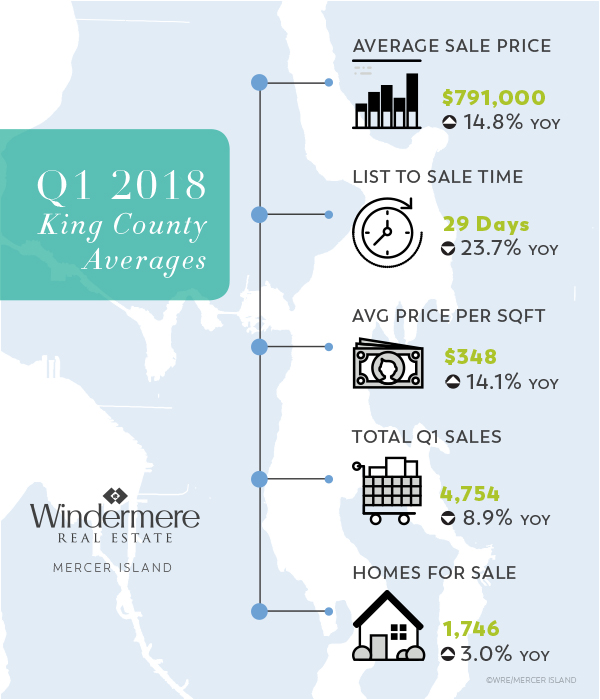

Q1 2018 Seattle-Eastside Real Estate Report

Q1 prices in the Seattle-Eastside region have escalated yet again with no sign of slowing in the immediate future. An unprecedented lack of inventory for sale coupled with rising interest rates has prompted buyers to compete with reckless abandon to win the prize of their very own home, albeit with a steep price tag.

Overall median prices in Seattle rose 16.1% to $770,000, while the Eastside rose 13.0% to $944,000. Those regional numbers certainly don’t tell the whole story, especially when you consider the highest change in median sale price was nearly 46% and the lowest was a -4%. New construction sales, or lack thereof, made the biggest impact on home sale prices. Existing homes, offering good walkability or commute options, and those that were on the more affordable end of the pricing spectrum saw the strongest appreciation overall.

Rising mortgage interest rates, now up a full percentage point from their lows, are adding fuel to the fire. While not dampening buyer demand yet, further increases will likely begin to price home buyers out of the core Seattle-Eastside region. Homebuyer fear of being priced out of the market is at least partly to blame for the crazed demand at more modest price points.

As predicted, many who don’t have a need to be close in to the metro region are choosing to sell at a high and buy more affordably outside of the Seattle-Eastside area. The rate of tear-down new construction infill has escalated at staggering numbers as builders capitalize on the market’s appetite for fresh and new.

Buyers today should consider their purchase thoughtfully as buying at or near the peak of the market can limit their resale options when the market corrects. Planning to stay put for five to seven years is a good strategy at this time.

SEATTLE

West Seattle leads the pack in median home price growth on the Seattle side of the lake. With its vibrant, hip vibe and convenient access to the city, West Seattle has benefited from Seattle’s commute gridlock—maintaining status quo while other Seattle neighborhoods have come to a halt (literally).

Queen Anne saw a nice rebound in Q1 after lagging the Seattle averages for some time. South Seattle, with its light rail access, affordable prices, and new vitality, continues to see its real estate market thrive.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

EASTSIDE

Significant new home development at higher price points has led the market in West Bellevue and Kirkland and brought up everything else along with it.

With land values alone higher than average home sale prices in surrounding communities, this growth will have long-lasting impacts that will forever change the flavor of these communities–for better (fresh new housing stock) and worse (the lack of affordable options). Kirkland led this charge with a median sale price 45.9% higher than Q1 last year, followed by West Bellevue at 23.1%.

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

Overall, a much higher percentage of mid-range homes sold in the first quarter than in quarters past, giving the appearance of falling prices. In reality, however, it was actually a downward shift of the segment of the market that is selling.

Don’t let the negative number for Q1 fool you. The market below the two-million-dollar mark is vastly different than the market above it. With the most severe shortage of available homes in mid-range price points Mercer Island has seen, especially early in Q1 this year, the sub $2 million market has been brisk and competitive with strong price escalation. The $2 million and above market has been a different story altogether. While highly desirable homes in that bracket have transacted quickly, many other less notable homes have languished on the market.

Click here to view the complete report for a neighborhood by neighborhood breakdown of Average Sale Price, size, and number of homes sold.

CONDOS – SEATTLE & EASTSIDE

Still the only affordable option for many home buyers today, condos have continued to escalate in value with appreciation rates above those of residential homes in many areas.

On the Eastside, new condo and townhome developments in Crossroads and Rose Hill drove prices up to new highs in those communities. Richmond Beach and Shoreline benefited from an infusion of new construction standalone condominium ‘homes’ on very small lots.

Check out all of these factoids and more in the full condo report.

WATERFRONT

Several significant sales accented an otherwise unremarkable quarter. A $26.8 million iconic Medina estate on 2.5 acres with 150 feet of waterfront set a new benchmark on the Eastside. Two $8+ million homes on the north end of Mercer Island–both newer construction with over 7,000 square feet–set the tone for the Island in 2018. Lake Sammamish, with a $4.2 million sale in Q1, is still in hot demand, while Seattle saw only three modest waterfront sales.

Check out the full Waterfront Report for a complete list of waterfront home sales by address and community.

ABOUT WINDERMERE MERCER ISLAND

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2018, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and deemed accurate but not guaranteed.v

Upping Your BBQ Game

With 4th of July quickly approaching, my brother and I recently chatted about what we’ll be barbecuing for the holiday. My brother is Mike Keller, the mastermind behind California Rancher which creates and sells an incredible line of all-natural, California-made gourmet seasonings and sauces for barbecue enthusiasts. The best barbecue dishes are simple, grilled dishes featuring excellent cuts of meat or farm-fresh veg, well-seasoned with herbs and spices, and elevated to perfection due to closely monitored time on the grill. In our discussion of holiday plans, the theme, “elevate and simplify,” started to develop.

With 4th of July quickly approaching, my brother and I recently chatted about what we’ll be barbecuing for the holiday. My brother is Mike Keller, the mastermind behind California Rancher which creates and sells an incredible line of all-natural, California-made gourmet seasonings and sauces for barbecue enthusiasts. The best barbecue dishes are simple, grilled dishes featuring excellent cuts of meat or farm-fresh veg, well-seasoned with herbs and spices, and elevated to perfection due to closely monitored time on the grill. In our discussion of holiday plans, the theme, “elevate and simplify,” started to develop.

I thought you might enjoy reading what we pinpointed as the essentials needed to up your bbq game. Here are the simple rules we think are indispensable when grilling:

- Pick the right cut of meat for your preferred dish. During college, both Mike and I worked at Chart House, a premier steak and seafood restaurant. Our server training was rigorous, and we memorized all the different cuts of meat and their characteristics. Filet Mignon is the most tender cut; top sirloin has the most flavor. New York Strip steak is the best of both worlds! Today, we’re fortunate to have access to a better selection of excellent meat choices, so we can find the right cut for what we want to serve our 4th of July crowd. Santa Maria bbq is a traditional California style of grilling. It involves slow cooking tri tip sirloin steak over red oak wood, which flavors the meat with its sweet smoke. You can achieve a similar effect at home, on your own grill, with a nice tri tip sirloin and your favorite Santa Maria Seasoning.

- #1 essential bbq tool is a digital thermometer. Mike’s mantra is that cooking to temperature produces perfectly grilled meat every time. The thermapen is Mike’s preferred digital thermometer. In Mike’s Santa Maria-Style Tri Tip recipe, he shares what temperature to cook to for rare steak (120F in the middle) or well done (up to 160F). It will take some practice to find the doneness temps for your grilled-to-perfection steak due to personal preference – for example, Mike’s personal preference is 115F in the middle for the ultimate rare steak experience. But with other types of meat, like poultry and pork, you need to reach a specific internal temperature to eliminate exposure to food borne illness. Click here for a helpful temperature chart courtesy of Food Network.

- Placement of the food on the grill to take advantage of heat levels. Depending on what type of grill you use, if you want to get a rich, smoky flavor you may have to move food off to the sides to cook it slower via indirect heat. If you use a smoker type barbecue, like the Big Green Egg (one of Mike’s favs!) or Traeger, you’ll need to plan time to smoke the food at a low temperature first before turning up the heat and cooking to the finish temperature. Slow and steady wins the race in the bbg game!

- Simple seasoning and sauces up the elegance of your grilled fare. My absolute FAVORITE dish Mike grills is beef tenderloin dusted with Santa Maria seasoning and slow cooked over red oak wood. That’s all there is to it. In fact, he made this for my last client appreciation event. He had chunks of red oak, a wood native to California, mailed to my house for this event. We enjoyed a lovely dinner at the Mercer Island Beach Club with Lake Washington as our backdrop, and Mike built up quite a fan club here on the island due to that evening! The beef tenderloin definitely stole the show, and it’s dead simple!

- When slicing meat, it’s important to cut against – or perpendicular to – the grain for maximum tenderness. A great piece of tri-tip or beef tenderloin can be reduced to shoe-leather tough if it’s sliced alongside the grain versus against it. And here’s a little know fact regarding the grain of a cut of meat: it often changes along as you slice through the piece, so you may need to adjust the angle of your slicing as you slice. For example, a tri-tip grain usually shifts 45+ degrees so the way you start slicing one end should typically be at a different angle than where you finish at the other end.

- The grill isn’t just for meat. Vegetables and fruits gain this amazing layer of epicurean goodness from time spent on the grill. My family goes nuts for kale chips cooked on the grill. I wash the kale, then massage it with olive oil and veggie rub. We especially like the charred edges of the large kale leaves that get smoky and crunchy. Other veggies that love a turn on the grill: asparagus, mushrooms, Brussel sprouts, beets, red potatoes. You can even lightly grill romaine lettuce for your next Caesar salad.

So there you have it! 6 easy rules to up your bbq game. These tips will be a great guide, and help you pull off your best 4th of July party to date. If you are in search of a new bbq recipe to try check here on California Rancher, or here for recipes courtesy of Big Green Egg.

And if you are wondering what Mike will be serving on the 4th, he’s planning on smoking a pork shoulder roast overnight in his Green Egg – it’ll be seasoned with Oaky & Smoky BBQ Rub mixed with a little brown sugar. With the help of the tool BBQ Guru, he will be able t o maintain a steady temperature of 175 degrees overnight. He’s going to pull it apart and serve with a variety of sauces for dipping, including Hog Wild Habanero BBQ Sauce. And here at the Wilson house, we’ll be going “Hog Wild” this 4th of July. I’ll be serving barbecue chicken reminiscent to a recipe Mike developed. First I’ll season the chicken with Hog Wild Cajun-Style Rub. Then I’ll pop the seasoned chicken onto the grill for a quick turn on a higher heat to add grill marks. Next, I’ll drop the temperature down to a lower heat and slow cook the meat for about 45 minutes, until the internal temperature reaches 165F. The chicken will be paired with Hog Wild Habanero BBQ Sauce for dipping. Yum!

o maintain a steady temperature of 175 degrees overnight. He’s going to pull it apart and serve with a variety of sauces for dipping, including Hog Wild Habanero BBQ Sauce. And here at the Wilson house, we’ll be going “Hog Wild” this 4th of July. I’ll be serving barbecue chicken reminiscent to a recipe Mike developed. First I’ll season the chicken with Hog Wild Cajun-Style Rub. Then I’ll pop the seasoned chicken onto the grill for a quick turn on a higher heat to add grill marks. Next, I’ll drop the temperature down to a lower heat and slow cook the meat for about 45 minutes, until the internal temperature reaches 165F. The chicken will be paired with Hog Wild Habanero BBQ Sauce for dipping. Yum!

Grilling for friends is always a good time. It’s extra special on the 4th of July because you typically get time away from the office to spend the day outdoors with good friends and family. Everyone contributes to the meal, adding their own special touches to the event. The celebration lasts well into the evening and culminates with a spectacular fireworks show or time around the fire pit. When you “elevate and simplify” your grilling technique, you will serve the best meal each time and increase the enjoyment your event because the stress level will be at a minimum. The memories made will be a treasure for years to come!

*BBQ photos courtesy of Mike Keller. Hog Wild gift pack photo courtesy of Julie Wilson.

Mercer Island Beach Club Swim Team – Time To Sign Up!

One of the programs offered by Mercer Island Beach Club (MIBC), which is so special for my own family, is Swim Team. It’s a long-standing tradition that spans over 6 decades and is still going strong. Swim Team features program options for all swimming abilities, from 6 and 7 year olds joining Little Waves all the way through to advanced high school swimmers. Not only do participants hone their swimming skills and make lasting friendships, they learn self-discipline, how to set goals and work as a team as they practice and compete.

One of the programs offered by Mercer Island Beach Club (MIBC), which is so special for my own family, is Swim Team. It’s a long-standing tradition that spans over 6 decades and is still going strong. Swim Team features program options for all swimming abilities, from 6 and 7 year olds joining Little Waves all the way through to advanced high school swimmers. Not only do participants hone their swimming skills and make lasting friendships, they learn self-discipline, how to set goals and work as a team as they practice and compete.

MIBC families – even though spring just arrived, it’s time to start planning for the 2015 Swim Team season! Registration is currently in session and runs until May 15th. You can register online here. Plus here are some dates to add to your family calendar:

- April 21 — Registration Night 6:00-8:00 pm at MIBC: Sylvia Swimwear staff will be on hand to help your swimmer find the right size suit. Logowear samples will be on hand for your swimmers to try on before you order. MIBC Logowear includes the following items: sweatshirt hoodies, zip up hoodies, warm up jackets with pants, sweat pants, pajama bottoms, pajama shorts, warm deck coats, embroidered towels & blankets, multiple colors of tote bags and custom swim caps.

- May 8 — Registration Deadline for Logowear and Apparel: Make sure your swimmer takes advantage of trying on the Logowear during Registration Night because once you place your order, the items cannot be exchanged or returned.

- May 15 — Registration Deadline for Swim Team: Online registration closes for all Swim Team levels.

- May 18 — Swim Team Opening Night: All swim team members’ first night of spring training. Parents will have a meeting at 6pm and the social committee will serve hot chocolate and cookies.

- May 18 to June 17 — Little Waves Introduction Session: The Little Waves will conduct their spring practice in two groups while they learn swim strokes and develop comfort in the pool.

- May 30th — Deadline for joining Team Unify calendar: Team Unify is used to schedule what meets swimmers will participate in, based on their availability. It’s also used to schedule parent volunteers for each meet. One parent for each swimmer competing in a meet must volunteer for 2 hours during the event to ensure the competitions run smoothly.

If you’d like to look at Swim Team swimwear prior to Registration Night, Sylvia Swimwear has two retail locations (Bellevue: 14100 NE 20th; Northgate: 9596 1st Ave NE, Seattle). You can go to either locations to try on suits. Once you determine the correct size your swimmer requires, you’ll need to order the suit from goswim.com. Click here for details on how to place your order online, but please note that the dates on the instructions were for the 2014 season.

My family is so excited for this year’s swim competition season! If you have any questions about the sign up timeline, or the upcoming spring practice that runs May 18th through June 19th, please ask in the comment section. See you at MIBC!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link