Renting vs Buying: Which is Better for You?

Knowing whether it’s the right time to rent or buy depends on your buying power, what you’re looking for in a home, your local market conditions, your plans for you and your household, and the responsibilities you’re prepared to take on at your residence.

Renting gives you greater flexibility to relocate, fewer home maintenance responsibilities, and can often be more the more affordable option, depending on where you live. The extra costs associated with owning a home—interest payments, taxes, repairs—may be too much for some renters to handle.

Becoming a homeowner also has its advantages. From a financial standpoint, owning is usually better than renting in the long term—it allows you to build wealth as your property gains equity; your monthly payments are stable and actually become more affordable over time relative to your income; and some of the costs may be deductible at tax time. From a lifestyle standpoint, owning also affords you greater freedom to customize your living space.

Ultimately, the right decision depends on your situation. If you don’t plan to be living in the same place for at least five years, renting might be more logical, as it allows you more flexibility when it comes time to move again. If you’re looking to settle down for the better part of a decade or longer and can afford to buy a home, becoming a homeowner may be the better option. Here are a few additional considerations to guide your renting-versus-buying decision making process.

What are the local real estate market conditions?

Investigate the local sales and rental markets to get an idea of both typical home prices and the average monthly payment for a rental. When comparing housing costs, be sure to base your evaluation on what’s happening in your city and neighborhood, not the nationwide averages. I track these stats regularly, so feel free to contact me for an accurate update on prices in your neighborhood.

For a quarterly breakdown of local market conditions in the Seattle area, explore my Market Review page. Each report breaks down the latest figures in home sales, home prices, and days on market for regions throughout Seattle and the Eastside. They also include helpful insights and data analysis.

What can you afford?

Making the jump from renter to homeowner is often a question of affordability. Your mortgage rate will depend on your financial strength, your credit score, and other factors, so make sure to talk to a loan officer before you start looking for a home. Getting pre-approved for a mortgage will identify what you’re able to afford and helps strengthen your offer when the time comes.

To get an idea of what you can afford, try these Financial Calculators. You can estimate your monthly payment for any listing price/mortgage terms to get a well-informed picture of whether it’s the right time to buy.

Will you need to make repairs to your new home?

Buying a fixer-upper may seem like a great way to get a deal on a house, but if the money you spend on the repairs is too great, your profit could be diminished when it comes time to sell. The same is true for remodeling and improvement projects. There are various renovation financing loans available to you that can help with the costs of home repairs, though extra consultations, inspections, and appraisals are often required in the process of securing these loans. Ultimately, if you can only afford a home that demands major improvements, and you don’t have the skills to do much of the work yourself, you may be better off renting.

Can you rent part of the house you’re buying?

If you buy a house with rental-capable space (extra bedroom, mother-in-law unit, etc.), you could use the rental income to pay off your mortgage faster and contribute more to your savings. But, of course, you need to be willing to share your home with a tenant and take on the responsibilities of being a landlord or working with a professional property manager to help you with those duties. Renting out a space in your home will also require you to purchase landlord insurance on top of your existing homeowners insurance policy.

Making Your Decision to Rent or Buy

At the end of the day, the decision is up to you. Based on the conditions laid out above, it simply may not be the right time for you to buy. Fortunately, when it comes to being a homeowner, it’s not now or never. I’m happy to be your resource in gauging whether it’s the right time to buy and guiding you through the process toward homeownership. To get started, connect with me today.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere blog April 11, 2022.

Remodeling Impact Report: Projects That Bring Joy & ROI

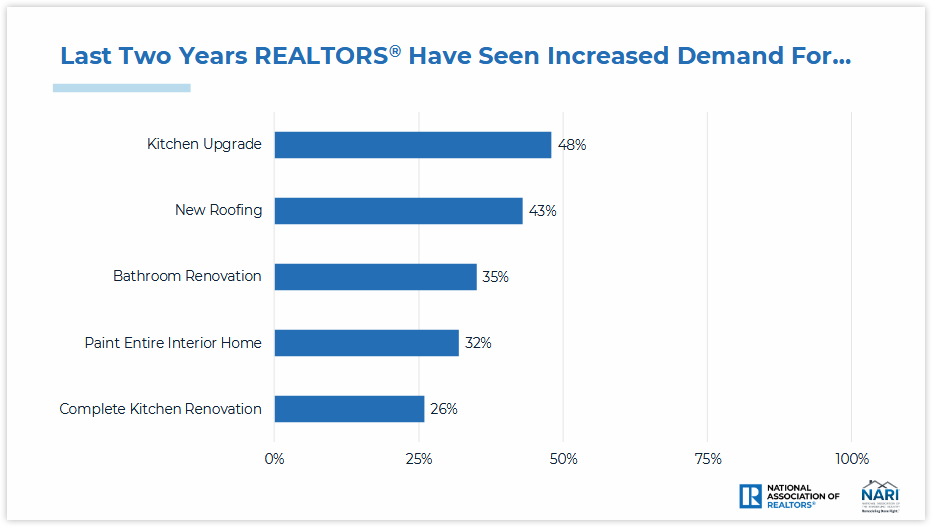

Is your home ready for a refresh? Whether it’s for their own enjoyment or to prep their houses for sale, Americans are investing more and more money into remodeling each year. According to a recent report by the National Association of REALTORS® (NAR), the demand for top-condition homes is going up among buyers as well. So which projects will get you the most bang for your buck? Or, perhaps more importantly, which projects will bring you the most joy? Here’s what the Remodeling Impact Report revealed…

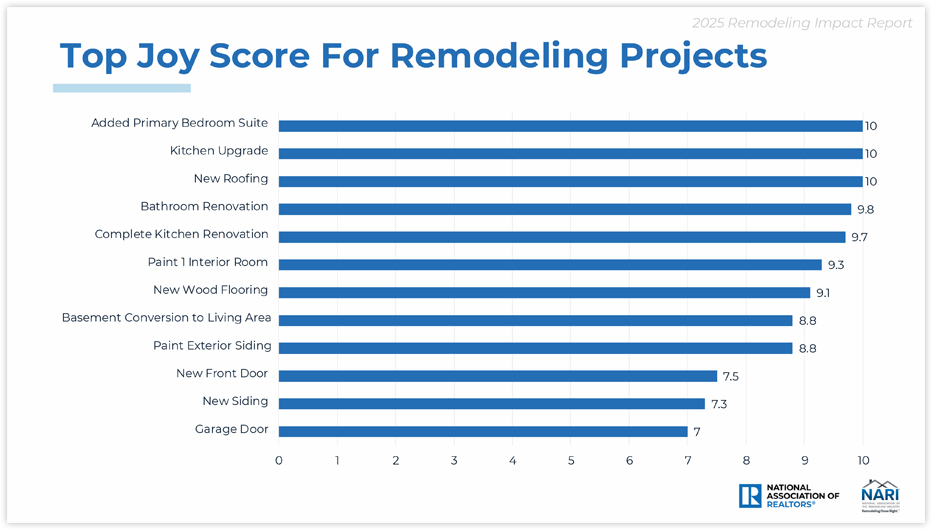

Projects That Boost Your Happiness

It’s easy to think about improvements in terms of monetary value…but what about the value of enjoyment and enhanced livability? As part of their report, NAR calculated a “Joy Score” for common remodeling projects based on the happiness homeowners reported with their renovations. Three projects stood out with perfect joy scores: adding a primary bedroom suite, upgrading the kitchen, and replacing roofing. Here are the projects with the highest joy scores:

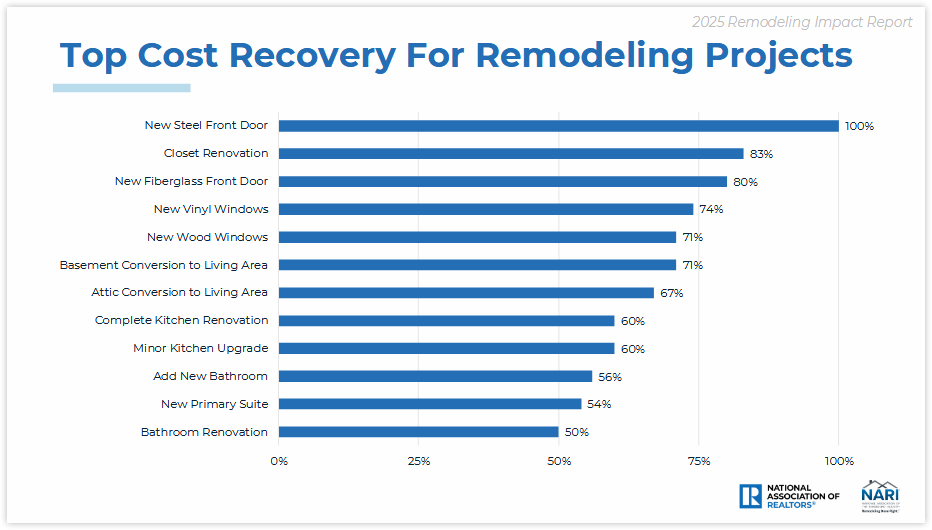

Projects That Help Pay for Themselves

As a bonus to bringing you joy, many projects will also pay you back for at least a portion of their cost when it’s time to sell your home. Projects that increase your home’s curb appeal tend to bring you the highest return on investment (ROI), although closet renovation snuck in as a surprise gem:

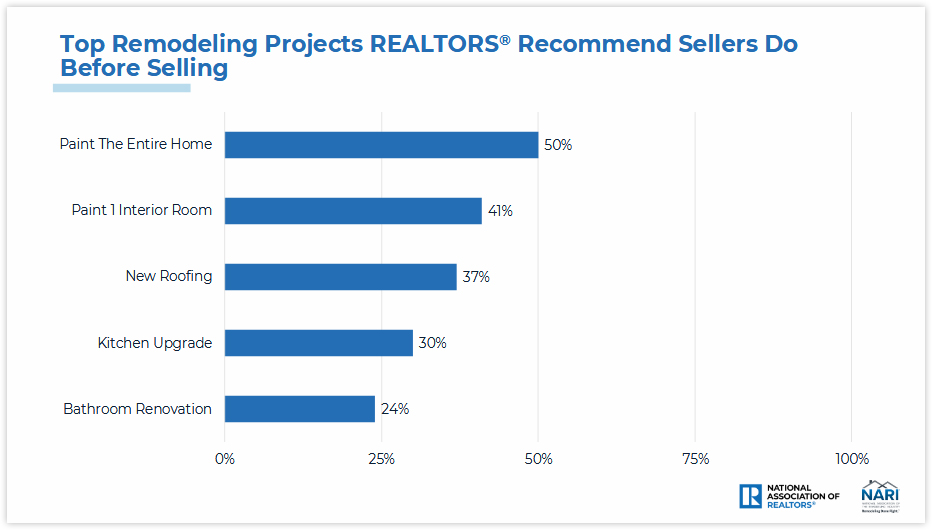

What If You’re Remodeling to Sell?

In virtually any real estate market, a home that feels fresh, clean, modern, and move-in ready will always sell faster and for more money than its dated counterpart. This isn’t always tangible in the ROI studies but, as agents, we see it every day. The good news is that the updates you make to sell are often more cosmetic and less expensive than the upgrades you might make if you were planning to stay in the home forever (pssst…check out this article on remodeling projects you should avoid if you’re selling your home).

The two charts below show both the projects REALTORS® most often recommend sellers do before selling, and five projects we’ve seen increased demand for from buyers:

It’s critical to understand that every home, neighborhood, and situation is different. Your home’s unique characteristics and your personal goals as a homeowner will have more impact on which remodeling projects are best for you than any of these general trends. If you’re remodeling to sell, reach out for advice; I’m happy to help you choose the right projects—and avoid the wrong ones—to help you accomplish your objectives.

Data & charts copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

© Copyright 2025, Windermere Real Estate/Mercer Island.

A Consumer’s Guide to Homeowners Insurance

If you’re a homeowner or looking to buy a home, insuring your property is critical to protecting your investment—and if you’re getting a mortgage, it’s a must. It can be daunting trying to navigate the many options available to you. What does your policy cover…and what isn’t covered? What does the insurance company provide if your property is damaged or destroyed? Recently, the National Association of REALTORS® released this helpful guide on understanding the ins and outs of homeowners insurance. Here is a quick rundown of what you need to know…

How does property insurance work?

For certain unexpected events that cause a loss to your home or property, homeowner’s insurance can cover the cost to repair/rebuild the property and other structures like fences or garages. Most policies also cover personal belongings within the home, legal/medical fees for accidents occurring on the property, and temporary housing if a covered event (like a house fire) makes your home uninhabitable.

What losses are covered?

Your insurance policy will list the specific “perils” that are covered. The most common type of policy covers both the structure and personal assets for losses from house fires, storms, freezing, theft, vandalism, and sudden plumbing bursts—this is known as a HO-3 or “Special Form” policy. Most policies don’t cover earthquakes or natural floods (although you can get additional policies for those perils).

Is insurance required?

There are no laws requiring you to maintain homeowners insurance. However, most lenders require it for the duration of your mortgage. Required or not, it’s generally a good idea to protect your assets (especially if you have a lot of equity in your home).

What is the cost, and how is it paid?

As with many costs, insurance premiums are on the rise throughout the country (here’s how much, where, and why). Your individual policy’s cost will be based on your home’s age, size, condition, location, and other factors like whether you have a security system or have added on additional coverage. You may have the option to pay the premium annually or break it into smaller payments. If you have a mortgage, the lender usually collects a monthly “escrow” payment that they keep in an account to pay the insurance premiums and property taxes from on your behalf.

What happens in the event of a loss?

Most insurers will cover “replacement cost”—the amount needed to buy a new, comparable version of what you lost up to a dollar limit specified in the policy. It’s important to understand that replacement cost is not the same as market value; you’ll be compensated for the actual cost to repair/rebuild/replace your home regardless of what you paid for it or what you could sell it for. Typically the insurer will reimburse you to have your home repaired or replaced with comparable quality if it’s insured to at least 80% of it’s replacement cost, less any deductible that your policy has.

Alternatively, “actual cash value” is the current value of an item that depreciates over time or with use (often used for replacing personal or under-insured property). For example, if you paid $2,000 for your new couch but now it’s only worth $1,000 due to normal wear and tear, your insurer will only pay $1,000 less the deductible. You may choose to upgrade your personal property coverage to replacement cost instead for an extra fee.

For extra peace of mind, you can also purchase an extended replacement cost policy that provides extra coverage up to a set percentage above the policy limit. This can protect you if your home costs more than anticipated to rebuild.

Are the premiums tax deductible?

The short answer is no, unless you run a business from your home or it’s a rental property. However, you may be able to claim a casualty loss deduction if you suffered a loss due to a federally declared disaster (but check in with your tax pro for advice specific to your situation).

Because laws vary from state to state, it’s important to do your homework if you’re purchasing a home in an unfamiliar area. You can either connect with me or your attorney for advice.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Is Downsizing Right for You? Here’s How to Decide

Choosing to downsize is more than just moving into a smaller space, it’s about curating a simpler lifestyle that fits your current needs. Whether you’re retiring, looking for an eco-friendly, low-maintenance home, or wanting a fresh start after your children have moved away, downsizing might be the best option for you. Before making the move, here’s everything to consider.

Why Downsizing Could Be the Right Choice

Increased Cash Flow & More Financial Flexibility

Downsizing can offer significant financial benefits, starting with a smaller mortgage, which frees up extra cash for other needs or desires. Home insurance costs also tend to be lower, as the size of the home typically influences insurance premiums. Downsizing to less square footage can also lower property tax bills. Finally, a smaller home also leads to decreased utility bills, as the cost of heating and cooling a smaller home requires less energy expenditure.

More Time, Less Maintenance & Stress

Bigger homes call for more maintenance. Downsizing can help cut down time spent on household chores such as cleaning and vacuuming, which will give you more hours to do something more enjoyable. Homeowners who have successfully downsized often feel happier because they are no longer overwhelmed by the demands of a larger home. Less responsibility, less housework, increased cash flow, and flexibility equals reduced stress.

A Greener Lifestyle

After downsizing, homeowners commonly buy less since they don’t necessarily have the room for it. Reduced consumption not only leads to a more minimalist lifestyle but also cuts down on waste. Less waste plus less energy expended to heat and cool the space means a smaller environmental footprint and keeps your home green.

What You Might Miss When Downsizing

While moving into a smaller space has benefits, there are trade-offs to consider. A smaller home means less storage space, meaning you’ll need to give away or donate furniture, books, kitchen supplies, and other belongings that may not fit. Less space and fewer rooms can also make the home feel cramped, especially if you’re a long-term homeowner used to larger square footage.

Remote work may also become more challenging in a downsized home. Finding a quiet, dedicated workspace can be difficult, and close quarters may make it harder to stay productive. Additionally, hosting overnight guests or bigger holiday dinners might be out of the question for a smaller home. Adjusting to a downsized lifestyle can take time for those accustomed to more space, requiring new habits and a fresh approach.

Questions to Ask Before Making the Move

Before downsizing, it’s crucial to reflect on how less space in your home will impact your lifestyle. Think about your attachment to your current home’s size. Do you need extra rooms for guests or a second bathroom for convenience? Will moving into a smaller home feel too much like a step backward? Or will it bring the sense of freedom and simplicity you’ve been looking for? Ask yourself these important questions to ensure you’re making the right choice:

- What are my must-haves in a smaller home? Think about what you might miss from a more spacious home, or factors like location, accessibility, and storage solutions.

- How will my daily routine change? Consider how a smaller space might impact your hobbies, work setup, or ability to entertain.

- Does this move align with my long-term plans? Imagine the next 5, 10, or even 20 years, and start to question if a smaller home meets your future needs.

- How much will it cost to downsize? Factor in moving expenses, costs associated with selling, new furniture purchases, and the amount it will cost to store or sell belongings you no longer have space for.

- What will I do with sentimental or bulky items? Consider whether you’ll keep, donate, sell, or store them, and how much space you’re willing to dedicate to cherished belongings.

If you believe downsizing is the right option and are ready for the next step, you’re probably asking yourself, “Should I sell first or buy first?” When you’re prepared to discuss your options, reach out to me for expert advice:

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog.

Selling Your Home: 5 Common Myths

Selling your home is a crash course in real estate education. My clients learn a LOT as we work together to find a buyer and sell at the right price. As you prepare to sell, it’s important to remember that that not everything you’ve heard is true. There are several common myths that can lead to costly mistakes in the selling process. Knowing the truth behind them will clarify your selling journey and help you align your expectations…

Myth 1: Home Value Calculators Are 100% Accurate

Online Automated Valuation Models (AVMs) are a great starting point for understanding how much your home could be worth. However, they are merely a first step in determining home value; to say they are 100% accurate is a myth. When it comes to pricing your home, you need to rely on a true Comparative Market Analysis (CMA), which uses vast amounts of historical and current data on real estate listings to arrive at an accurate and competitive figure.

To get an estimate of how much your home is worth, try our Home Worth Calculator here:

Myth 2: Selling FSBO Will Save You Money

Selling a home requires an intimate knowledge of the housing industry and how to solve the complex situations that arise throughout a real estate transaction. Despite this, some sellers will go it alone and attempt to sell their property without being represented by an agent.

Selling For Sale by Owner (FSBO) is a risky proposition. It requires the seller to bear added liability, fills their schedule with various marketing and promotional responsibilities, and can leave money on the table by inaccurately pricing the property, causing it to sit on the market for too long. The potential costs of selling a home on your own far outweigh the commission real estate agents earn on a home sale.

Myth 3: You Must Remodel to Sell Your Home

The question you’ll face when preparing to sell your home is whether to sell as is or remodel. The answer usually lies somewhere in between, but it depends on your situation and what kinds of home upgrades are driving buyer interest locally. When making improvements to your home, lean toward high ROI remodeling projects to get the best bang for your buck, and avoid trendy projects that can delay listing your home. If you’re considering major upscale renovations, talk to me about which projects buyers in your area are looking for.

Myth 4: Never Accept the First Offer

You’ve likely heard tell that the first buyer’s offer is nothing more than a springboard to up your asking price and to never accept it. In this case, “never” should be approached with caution. In reality, the best offer for your home is one that you and your listing agent have discussed that aligns with your goals. If a matching offer happens to be the first one that comes your way, so be it. The market can shift at any time, so you never know what may happen if you leave an offer on the table. And if the buyer backs out of the deal, you and your agent will find a path forward.

Myth 5: Home Staging Doesn’t Make a Big Difference

Staging your home is so much more than a cosmetic touch-up; it has been proven to help sell homes faster and at a higher price than non-staged homes.1 Staging ensures that your home has universal appeal, which attracts the widest possible pool of potential buyers. When buyers are able to easily imagine living in your home, they become more connected to the property. You should stage your home regardless of your local market conditions, but it can be especially helpful in competitive markets with limited inventory where even the slightest edge can make all the difference for sellers.

Now that you know some of the most common myths in the selling process, get to know its truths. Connect with me to get the process started:

1: National Association of REALTORS® – Why Home Staging Inspires the Best Prices in Any Housing Market

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

Understanding Contingent Offers: A Seller’s Guide

With the market shifting toward balance between buyers & sellers, “contingent” is a word sellers will be seeing more of. It’s important to understand the difference between a “contingent offer” and one with “contingencies.” Contingent offers allow the buyer time to sell their current home first before they complete the purchase. On the other hand, an offer with contingencies allows the buyer to cancel the contract with a full earnest money refund if the specified conditions aren’t met—often a satisfactory home inspection or the ability to obtain financing.

This may feel a bit like buyers want to have their cake and eat it too, but every homeowner can understand the desire to protect their investment before fully diving in. In a seller’s market, there are fewer homes available, which means buyers will do whatever they can to make their offer stand out. Because sellers have the leverage in these market conditions, you’ll often see buyers waiving their contingencies. Talk to your agent for more information about the local market conditions in which you’re selling.

Should I accept a contingent offer on my house?

Each home sale is different, and each seller has a unique story. What you’re looking for in an offer may be different from what someone else in your neighborhood is looking for when selling their home. It all depends on your circumstances, your timeline, your next steps, and your local market conditions. The extra stipulations in a contingent offer require the attention of an experienced real estate agent who can interpret what they mean for you as you head into negotiations.

How often do contingent offers fall through?

Contingent offers can fall through more often than non-contingent ones, but there’s no general rule of thumb. Whether a sellers and buyer are able to agree on the terms of a deal is a case-by-case situation. Different contingencies may carry different weight among certain sellers, and local market conditions usually play a significant role. For up-to-date information about your local market, visit our Market Reports page or Trends on our blog.

Pros and Cons of Contingent Offers for Sellers

Pros of Contingent Offers (allowing the buyer to sell their current home first):

- Accepting a contingent offer means you don’t have to take your home off the market quite yet, since the conditions of the deal haven’t been met. If the buyer backs out of the deal, you can sell without having to re-list.

- In certain cases, some buyers may be willing to pay extra to have their contingent offer met even if the home has been on the market for an extended period.

Pros of Offers with Contingencies (such as inspection, title, financing, etc.):

- You’ve got an offer! In a balanced market, one offer with contingencies is still better than no offers.

- It may protect you legally if you give the buyer the opportunity to do all of their due diligence while under contract. It’s harder for a buyer to come back and say something wasn’t disclosed when they had ample time and the contractual right to due diligence.

Cons:

- Home sales with any types of contingencies are usually slower than those without. It takes time to satisfy a buyer’s contingencies and additional time to communicate that they have been met.

- There’s a higher risk that the deal could fall through since the the buyer isn’t locked into the contract until of their contingencies have been satisfied.

It’s important to have an agent you can trust for guidance when facing contingent offers. Reach out to me any time—I’m never too busy to give advice or answer questions:

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

9 Fun Summer DIY Projects for Your Home

Sun’s out…fun’s out! Our glorious PNW summer is coming in hot with endless opportunities to enjoy the outdoors. Here are some fun and easy project ideas to help you make the most of it!

1. Backyard Movie Theater

Outdoor movies are a great way to enjoy your yard and entertain a crowd (and keep the mess outside, too!). Looking for affordable and easy? You can find portable, outdoor, Bluetooth enabled projectors for under $100; hang up a white sheet or inexpensive screen, grab your portable Bluetooth speaker, and BOOM…it’s movie time. Ready to take the leap and create something more lasting? Here is a great how-to for a wooden frame with pull-down screen + helpful tips for your AV setup.

2. Fire Pit

Who doesn’t love a good s’mores roast? Creating an attractive fire pit may be easier and cheaper than you imagined. One beautifully simple method we love is to create a ring of stacked bricks, stones or cinder blocks on top of a level pea gravel base, then place a store-bought metal fireplace bowl in the center (here is the full how-to). It’s remarkably fast and you don’t even need mortar! You can also go for a modern square look with cinder blocks, use a reclaimed metal receptacle, or find a full kit at the hardware store. Check out this list of 31 DIY fire pit ideas from the Spruce.

3. House Number Planter

Looking to add some instant curb appeal to your home? This elegant, inexpensive design may just be the “WOW!” you’re looking for. Choose modern house numbers for an updated look and then a little wood, some pretty plants, and a couple hours of work is all it takes to make your neighbors jealous.

Photo courtesy of ana-white.com

4. Giant Backyard Jenga

We LOVE this idea for summer BBQs, and it’s so easy! All you need are some 2×3 boards, a miter saw, and sandpaper (or a power sander, if you have one). Bada bing bada boom…jumbo Jenga to entertain kids and adults alike. Here are full instructions courtesy of Her Tool Belt, including the option to go fancy with colors and a DIY carrying crate that also doubles as a stand.

5. Decorative A/C Screen

If you’re lucky enough to have central A/C, you’re also unlucky enough to have an unsightly metal unit sitting in your yard. Fortunately, you can build a simple cover for less than $100 and in less than a day. Here is an easy plan from This Old House, designed with widely spaced slats for air flow and 1 foot of clearance (do your homework on your specific A/C unit before you dive in—you may need to size up). You can paint it to match your house color if you want to go incognito, or stain it for a stylish natural wood look.

Photo courtesy of tarynwhiteaker.com

6. Vertical Garden

Taking advantage of vertical space for planting means that even the smallest of patios can host a garden. It could be as simple as attaching pots to a trellis/rail or framed chicken wire, or something more elaborate like this beautiful living wall by This Old House. Vertical gardens can also double as privacy screens for your yard, porch or patio. Veggie enthusiasts can even build this easy vertical ladder planter with its own drip watering system. For the ultimate quick fix, felt pocket planters offer instant gratification—just attach to your fence or wall, add potting soil + slow release fertilizer + drought-tolerant plants, and water every 2 days. Using freestanding shelves for your container garden is another great option, especially for tenants who need something that is easily removable.

7. Leopold Bench

We love conservationist Aldo Leopold’s simple and iconic wooden bench plan, designed to be used both forward (with a backrest) or backward (where the backrest becomes an elbow rest for using binoculars). Here is a super easy DIY plan with cutting instructions from Construct101. Even amateurs can build this in less than a day, and all it takes are three boards, 6 carriage bolts, and some screws!

Photo courtesy of etsy.com

8. Hose Storage Planter

This ingenious project will boost your curb appeal in two ways, both by being an attractive planter AND by stowing away unsightly hoses in a clever hidden storage compartment. There are a few different styles and plans out there. We like this version from DIY Candy with a hinged front that allows you to access the hose without having to lift up the heavy planter. It can be crafted from a pallet or any other reclaimed wood. The Kim Six Fix also has this version made with cedar fence boards instead.

Photo courtesy of diycandy.com

9. Rain Garden

Did the April showers leave your yard (or basement) a little soggy? Sump pump working overtime? A rain garden is a beautiful way to channel water away from your house while also helping the environment by keeping chemical runoff out of rivers and lakes. The concept is pretty simple: create a below-grade garden bed planted with deep-rooted species that help capture and drain water rapidly into the soil. If you’re serious about improving drainage, you’ll also want either a stone channel or buried PVC pipe to help guide water from your downspout into the garden. Collect some friends to help with the digging! Here are full instructions from the Family Handyman.

If you’re considering selling your home, some of these projects—like planters and vertical garden privacy screens—can help maximize your curb appeal. A rain garden might also be a beautiful solution for drainage issues that need to be resolved before your house can go on the market. Looking for more ideas or advice? Reach out to me any time…I’m never too busy to help!

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2024, Windermere Real Estate/Mercer Island.

Why Buyer Representation Matters So Much to Sellers

In today’s rapidly changing real estate landscape, understanding the critical role of buyer representation has never been more essential for home sellers. With the pending NAR settlement on the horizon, many sellers may not fully grasp the significant impact these changes will have on their transactions. The urgency to adapt is real, and overlooking the necessity of paying a buyer agent compensation could expose sellers to unforeseen risks.

Currently, home buyers are not allowed to roll their buyer agent compensation into their loan. This means they must bring cash to the table to pay their agent (if the seller is not offering buyer agent compensation).

Unrepresented buyers should be considered more than a minor hiccup—it can lead to a cascade of complications that jeopardize the entire deal. To safeguard your investment and ensure a smooth transaction, it’s crucial to recognize the invaluable support a buyer’s agent provides.

What value does a seller receive if the buyer has professional representation? Let us list the ways:

Lender Connections: Buyer agents connect their buyers with well-vetted (and typically local) lender partners who have proven time and again that they can close a transaction, and on time.

Documentation Management: Buyer agents ensure that buyers have delivered all necessary documentation to the lender to ensure full underwriting.

Market Analysis: Buyer agents provide comparable market analysis reports (CMAs) to help buyers understand the market value of the home and support a reasonable offer price.

Contract Guidance: Buyer agents guide their clients through the purchase and sale agreement, ensuring that they understand the terms and conditions and their ability to fulfill their commitments.

Contingency Explanation: Buyer agents explain all contingencies to buyers, ensuring they understand the risks and rewards, especially when waiving contingencies.

Earnest Money Handling: Buyer agents ensure that earnest money funds are delivered to escrow on time.

Transaction Deadlines: Buyer agents ensure that their client and their lender observe and adhere to all deadlines to keep the transaction flowing smoothly and closing on time.

Inspection Access: Buyer agents provide access to home inspectors and help their buyers understand the reports. This is critical as most MLS associations require an agent to be present whenever a door is opened. If the buyer doesn’t have representation, the listing agent must give access, exposing them to inspection findings and forcing them to disclose on behalf of the seller.

Appraisal Assistance: Buyer agents give access to appraisers and typically provide reports of comparable properties to support the purchase price, ensuring the property appraises at value.

Negotiation Support: If the appraisal report comes in less than the purchase price, the buyer agent will help negotiate and collaborate with the listing agent to ensure a mutual agreement is reached by all parties.

Transaction Coordination: Most importantly, the buyer agent helps keep their client and all parties on track to ensure closing, and crucially, on time.

The value a buyer agent brings to the transaction is indispensable. Their expertise not only facilitates a smoother process but also protects all parties involved from potential pitfalls. By ensuring the buyer has professional representation, sellers can avoid significant risks and secure a successful transaction. In the evolving real estate market, investing in buyer agent compensation is a wise decision that benefits everyone involved.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere blog on 5/29/24 & Inman News on 5/21/24.

7 Ways to Make Life Easier When Selling Your Home

When it’s time to sell a home, we all dream of a flawlessly executed transaction where everything goes smoothly and ends with a win-win for you and the buyer. Here are seven tips to help make that happen—and avoid surprise expenses along the way…

1. Repair Your Home First

Making repairs to your home before you sell not only makes it more appealing to buyers, but it can also help you avoid the additional costs that can result from the buyer’s inspection. Disclosing any repairs that still need to be made will help you move smoothly to closing and avoid problems that could otherwise kill the deal. Consider conducting a pre-listing inspection to make sure everything is out in the open before you sell.

2. Make Sure Your Price is Right

The key to selling your home quickly is to find the right buyers. To find the right buyers, your home must be correctly priced. I use a Comparative Market Analysis (CMA)—a thorough, data-backed examination of your home and how it compares to other listings in your area—to accurately price your home. Without an agent’s CMA, it’s easy for your home to be listed at the wrong price.

-

- Avoid Overpricing: Overpricing your home will attract the wrong buyers because you will force your home into competition with other listings that are fundamentally superior or have more to offer. When comparing other homes to yours, buyers will focus on the discrepancies and the features your home lacks. Overpricing will often cause homes to sit on the market for extended periods of time and become less appealing to buyers.

-

- Avoid Underpricing: Under competitive market conditions, intentionally underpricing a home is a common strategy to attract buyer attention with the goal of starting a bidding war to drive the price of the home up. However, several things must go correctly for this to happen. In all other cases, underpricing your home reflects a lack of knowledge about where its market value fits into the fabric of current local market conditions and can leave you, the seller, unsatisfied with the price your home ultimately fetches.

3. Invest In Staging & Professional Photography

First impressions matter when selling a home. The vast majority of buyers are searching online and taking virtual tours of homes they’re interested in. As such, it’s well worth the time and money to hire a high-quality photographer and I always provide this for my sellers. The right photography can make all the difference in the minds of buyers.

Home staging is also a critical element for getting the most value for a home and selling it quickly. You can even DIY if you have the time and modern decor. It’s also the perfect time to inspect your home for any minor or cosmetic repairs that can be addressed quickly. An aesthetically pleasing home will attract more eyes, and any edge you can give your home over competing listings may be just the ticket to getting it sold.

4. Keep Your Emotions in Check

Selling your home is an act of learning how to let it go. Once you know you’re ready to sell, you’ll need to be able to look at it with an objective eye. This will allow you to approach decisions from a neutral standpoint and work towards what is best for the sale of the home. Having clear judgement will also help you get through the negotiating process and steer yourself toward a smooth closing. Stepping back can be tough, but a good agent will always be happy to give you guidance and help you keep perspective.

5. Wait Until You’re Ready

It may be tempting to rush your listing to take advantage of local market conditions, but waiting until you have all your ducks in a row will make life so much easier. Knowing when to sell your home is a mixture of being financially prepared, having the right agent, and understanding how your home fits into the current local market landscape. Once you’re ready, here are some tips on timing the market.

6. Use an Agent

…and I’m not just saying it because I’m an agent! Selling a home “For Sale By Owner” (FSBO) can save on commission fees, but is a complex and risky process that can easily lead to serious costs. An agent will help you front marketing costs, provide sound advice to help you avoid legal trouble, and ultimately shoulder some of the liability for the transaction. Being represented by an experienced professional will help you avoid mistakes during the offer process, negotiations, and closing that could otherwise be costly or jeopardize the sale. It’s no wonder that a vast majority of sellers choose to work with an agent.

7. Be Willing to Negotiate

Approaching buyers’ offers with an open mind will ensure you don’t miss any opportunities. Before the offers start to come in, it’s important to work with your agent to understand your expectations and strategize which terms and contingencies you’re willing to negotiate on. That way, you can quickly identify the right offer when it comes along. Showing a willingness to work with buyers will also keep them engaged and make sure you don’t leave potential deals on the table.

© Copyright 2023 Windermere Mercer Island.

Adapted from articles that originally appeared on the Windermere blog, November 22, 2021 & April 7, 2021, by Sandy Dodge.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link