Remodeling Impact Report: Projects That Bring Joy & ROI

Is your home ready for a refresh? Whether it’s for their own enjoyment or to prep their houses for sale, Americans are investing more and more money into remodeling each year. According to a recent report by the National Association of REALTORS® (NAR), the demand for top-condition homes is going up among buyers as well. So which projects will get you the most bang for your buck? Or, perhaps more importantly, which projects will bring you the most joy? Here’s what the Remodeling Impact Report revealed…

Projects That Boost Your Happiness

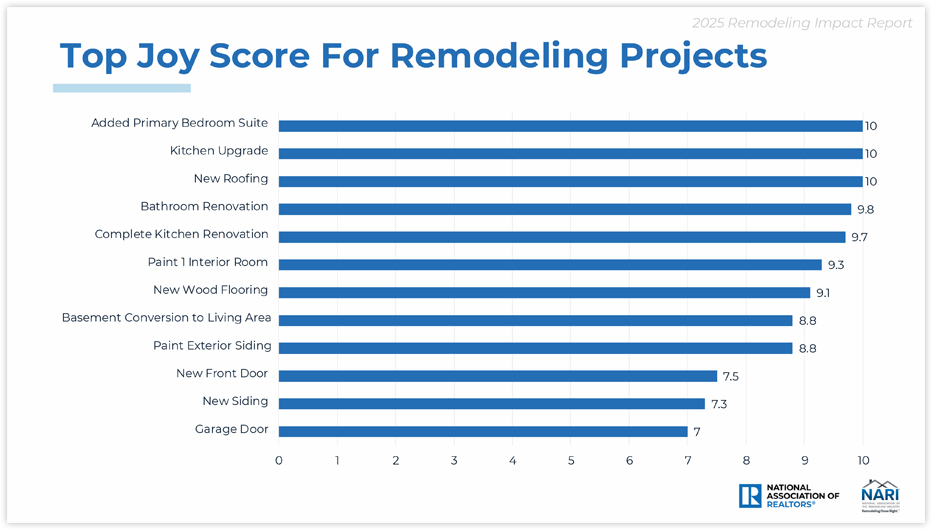

It’s easy to think about improvements in terms of monetary value…but what about the value of enjoyment and enhanced livability? As part of their report, NAR calculated a “Joy Score” for common remodeling projects based on the happiness homeowners reported with their renovations. Three projects stood out with perfect joy scores: adding a primary bedroom suite, upgrading the kitchen, and replacing roofing. Here are the projects with the highest joy scores:

Projects That Help Pay for Themselves

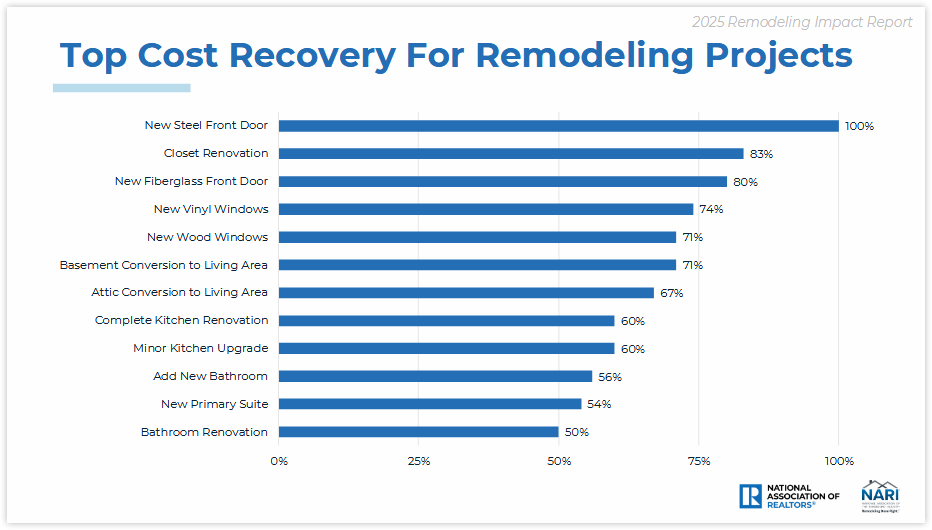

As a bonus to bringing you joy, many projects will also pay you back for at least a portion of their cost when it’s time to sell your home. Projects that increase your home’s curb appeal tend to bring you the highest return on investment (ROI), although closet renovation snuck in as a surprise gem:

What If You’re Remodeling to Sell?

In virtually any real estate market, a home that feels fresh, clean, modern, and move-in ready will always sell faster and for more money than its dated counterpart. This isn’t always tangible in the ROI studies but, as agents, we see it every day. The good news is that the updates you make to sell are often more cosmetic and less expensive than the upgrades you might make if you were planning to stay in the home forever (pssst…check out this article on remodeling projects you should avoid if you’re selling your home).

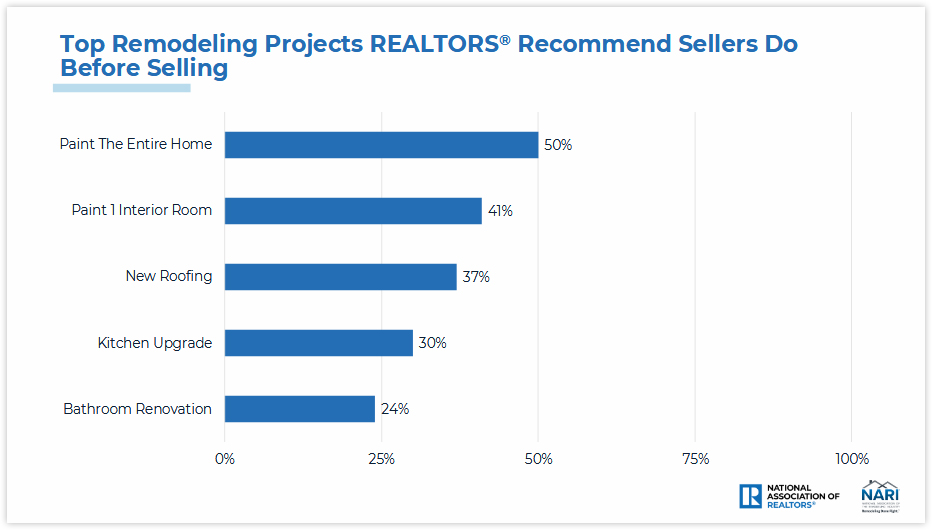

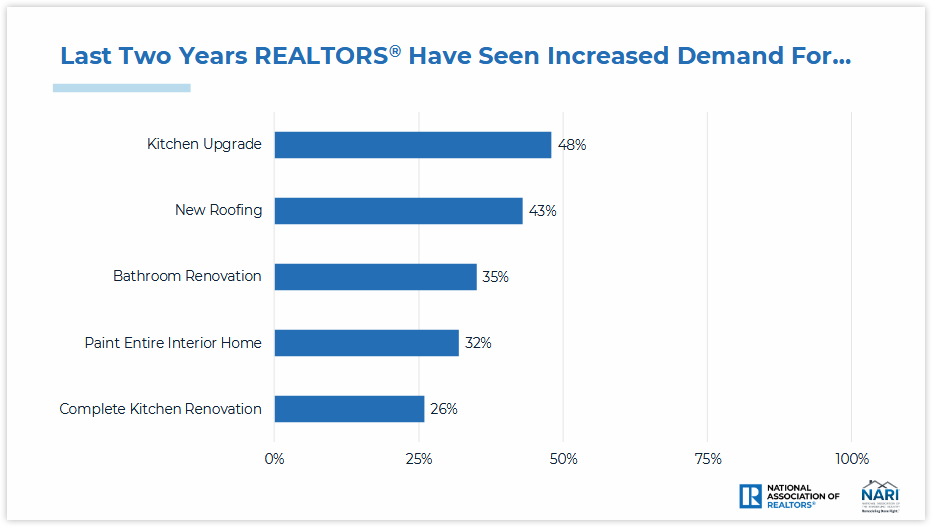

The two charts below show both the projects REALTORS® most often recommend sellers do before selling, and five projects we’ve seen increased demand for from buyers:

It’s critical to understand that every home, neighborhood, and situation is different. Your home’s unique characteristics and your personal goals as a homeowner will have more impact on which remodeling projects are best for you than any of these general trends. If you’re remodeling to sell, reach out for advice; I’m happy to help you choose the right projects—and avoid the wrong ones—to help you accomplish your objectives.

Data & charts copyright ©2025 “2025 Remodeling Impact Report.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. April 9, 2025, https://www.nar.realtor/sites/default/files/2025-04/2025-remodeling-impact-report_04-09-2025.pdf.

© Copyright 2025, Windermere Real Estate/Mercer Island.

Selling Your Home: 5 Common Myths

Selling your home is a crash course in real estate education. My clients learn a LOT as we work together to find a buyer and sell at the right price. As you prepare to sell, it’s important to remember that that not everything you’ve heard is true. There are several common myths that can lead to costly mistakes in the selling process. Knowing the truth behind them will clarify your selling journey and help you align your expectations…

Myth 1: Home Value Calculators Are 100% Accurate

Online Automated Valuation Models (AVMs) are a great starting point for understanding how much your home could be worth. However, they are merely a first step in determining home value; to say they are 100% accurate is a myth. When it comes to pricing your home, you need to rely on a true Comparative Market Analysis (CMA), which uses vast amounts of historical and current data on real estate listings to arrive at an accurate and competitive figure.

To get an estimate of how much your home is worth, try our Home Worth Calculator here:

Myth 2: Selling FSBO Will Save You Money

Selling a home requires an intimate knowledge of the housing industry and how to solve the complex situations that arise throughout a real estate transaction. Despite this, some sellers will go it alone and attempt to sell their property without being represented by an agent.

Selling For Sale by Owner (FSBO) is a risky proposition. It requires the seller to bear added liability, fills their schedule with various marketing and promotional responsibilities, and can leave money on the table by inaccurately pricing the property, causing it to sit on the market for too long. The potential costs of selling a home on your own far outweigh the commission real estate agents earn on a home sale.

Myth 3: You Must Remodel to Sell Your Home

The question you’ll face when preparing to sell your home is whether to sell as is or remodel. The answer usually lies somewhere in between, but it depends on your situation and what kinds of home upgrades are driving buyer interest locally. When making improvements to your home, lean toward high ROI remodeling projects to get the best bang for your buck, and avoid trendy projects that can delay listing your home. If you’re considering major upscale renovations, talk to me about which projects buyers in your area are looking for.

Myth 4: Never Accept the First Offer

You’ve likely heard tell that the first buyer’s offer is nothing more than a springboard to up your asking price and to never accept it. In this case, “never” should be approached with caution. In reality, the best offer for your home is one that you and your listing agent have discussed that aligns with your goals. If a matching offer happens to be the first one that comes your way, so be it. The market can shift at any time, so you never know what may happen if you leave an offer on the table. And if the buyer backs out of the deal, you and your agent will find a path forward.

Myth 5: Home Staging Doesn’t Make a Big Difference

Staging your home is so much more than a cosmetic touch-up; it has been proven to help sell homes faster and at a higher price than non-staged homes.1 Staging ensures that your home has universal appeal, which attracts the widest possible pool of potential buyers. When buyers are able to easily imagine living in your home, they become more connected to the property. You should stage your home regardless of your local market conditions, but it can be especially helpful in competitive markets with limited inventory where even the slightest edge can make all the difference for sellers.

Now that you know some of the most common myths in the selling process, get to know its truths. Connect with me to get the process started:

1: National Association of REALTORS® – Why Home Staging Inspires the Best Prices in Any Housing Market

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link