Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

What is an Adjustable-Rate Mortgage (ARM)?

Securing the most advantageous financing for your situation is an integral part of the success formula of buying a home. After getting pre-approved but once you’ve found the home you’d like to pursue, one of your primary tasks is exploring different loan products to see which best fits your situation. This is the fork in the road where you’ll need to decide between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). The following information will help you gain a better understanding of ARMs to help you decide whether they’re right for you.

What Is an Adjustable-Rate Mortgage (ARM)?

After your down payment, your mortgage will finance the remainder of your home purchase. Whereas fixed-rate mortgages allow you to lock in a specific interest rate and payment for the life of your loan, adjustable-rate mortgages’ interest rates will fluctuate over time, thus changing your loan payment. It’s typical for ARMs to begin with a low introductory interest rate, but once that first stage of the loan has passed, they will begin to shift up and down. ARMs generally have a cap that specifies the maximum rate that can occur for that loan.

Let’s say you secure an adjustable-rate mortgage with 30-year terms, the first five of which are at a fixed rate. When the variable interest portion of the loan kicks in, your mortgage’s fluctuations will be measured against an index. If the index is higher than when you secured the loan, your rate and loan payment will go up—and vice versa. How often your ARM rates change depends on your agreement with your lender. Talk to your mortgage broker to learn more about the characteristics of adjustable-rate mortgages.

Pros and Cons of an Adjustable-Rate Mortgage (ARM)

| Pros | Cons |

|

|

|

|

|

|

|

Different Types of Adjustable-Rate Mortgages (ARMs)

Hybrid ARM: As outlined above, a hybrid ARM begins with a fixed-rate introductory period followed by an adjustable-rate period. Typically, a hybrid ARM’s fixed-rate period lasts anywhere between three to 10 years, and its rates adjust at an agreed-upon frequency during the adjustable-rate period, such as once every six months or once a year.

Interest-Only ARM: With an interest-only ARM, you pay just the interest on the loan for a specified introductory period, then the principal payments kick in on top. The longer the introductory period, the higher your payments will be when the delayed principal payments enter the equation.

Payment-Option ARM: Not all states allow these loan products because they can get home buyers into hot water quickly if rates increase. They include flexibility to choose your monthly payments with a payment-option ARM, including interest-only payments and minimum payments that don’t cover interest.

Home Monthly Payment Calculator

To get an idea of how your mortgage payment will fit into your budget, use our free Home Monthly Payment Calculator by clicking the button below. With current rates based on national averages and customizable mortgage terms, you can experiment with different values to get an estimate of your monthly payment for any listing price.

Adapted from an article that originally appeared on the Windermere blog September 28, 2022. Written by: Sandy Dodge.

© Copyright 2022, Windermere Real Estate/Mercer Island.

How to Avoid Overpaying for a Home in a Transitioning Market

Look Carefully at the Home Itself

Here are four home attributes beyond the number of bedrooms and baths that you should have your eye on…

Home (building) quality: Very well-built homes are a rare find and typically worth every penny of their price. Don’t confuse them with so-so homes that just measure up to the city inspector’s threshold. Lesser quality homes will cost you more in upkeep and replacement as systems and components wear out. If you purchase a lesser quality home for less, the differential might just cover the added maintenance expense. But, if you purchase a fair quality home at the going rate of higher quality homes, you might likely be overpaying.

Deferred maintenance: Different than home quality, deferred maintenance includes the to-do list of items that need to be done to maintain a home’s integrity. A home that has been well maintained over its life typically is a better investment than one that hasn’t. The true cost of deferred maintenance often adds up to more than the cost of the repairs themselves. Don’t forget to factor in the reduced life span of other components—like replacement of damaged wood beneath peeling paint or mold remediation in a damp basement caused by a clogged foundation drain.

Setting: The saying “location, location, location” didn’t get its fame from out of nowhere. A home with an ideal setting on its lot and in the neighborhood—away from busy roads and utility poles/boxes, with adequate privacy, good topography, best positioned to capture views if available, and not adjacent to undesirable elements (poorly maintained homes, water towers or other unsightly public structures, high traffic facilities, etc.) will have more value than a less-ideally sited home. When deciding what to pay for a property it is critical that you evaluate these aspects and any others relevant to a specific neighborhood to determine the +/- effect on value.

Floor plan: How a home lives—flow from room to room, size of rooms, open/closed-off spaces, and below ground vs. above ground living are every bit as important as the total home square footage. You can change a lot of things about a home, but it is very difficult to change a bad floor plan. When you are deciding how high to make that multiple offer bid, consider factoring in the added value or take-away of the floor plan.

Beyond the Four Walls

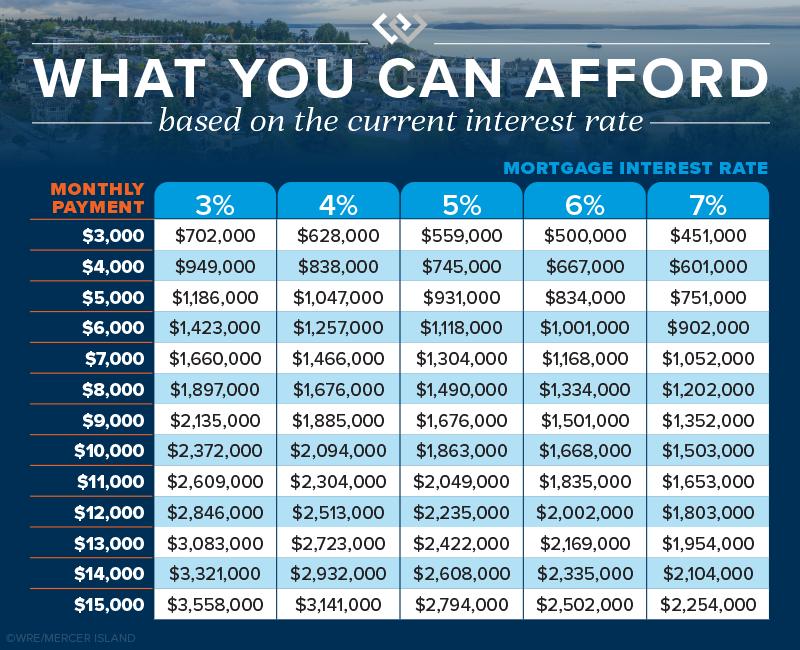

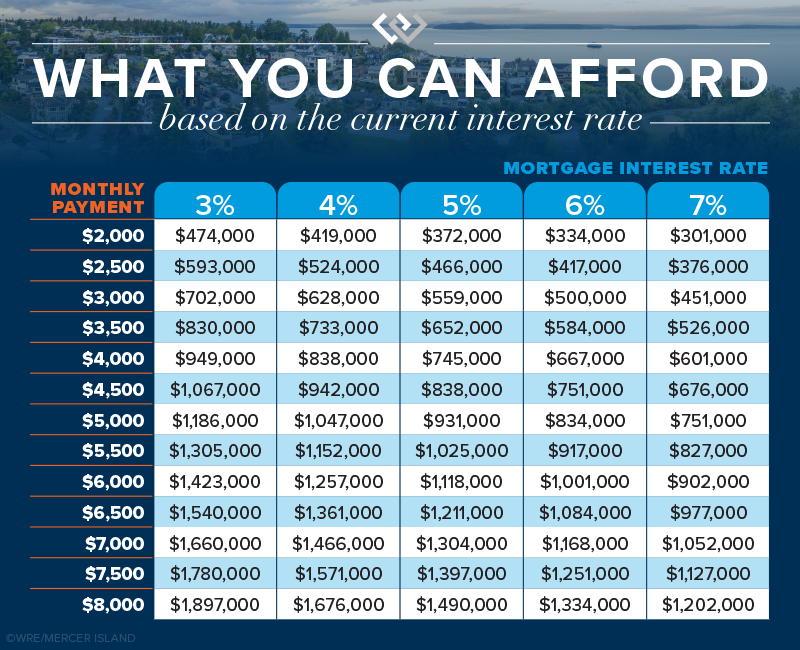

Interest Rates: In addition to being more selective about the home itself, it pays off to understand how interest rates impact your monthly housing cost. It’s a bigger deal than you might think. Every 1% increase in interest rate equates to roughly a 10% decrease in buying power. Said differently, a 10% drop in home sale price would be wiped out by a subtle 1% increase in mortgage interest rate. This means you can obtain a much more expensive home when rates are low, whereas higher rates get you less home—even though you still pay the same monthly payment.

If you have $5,000 a month to budget for a house payment (before taxes and insurance), you could purchase a $931,000 house at a 5% mortgage rate. If rates went up to 6%, the same monthly payment would only get you an $834,000 home. Your buying power diminishes considerably with each bump up in rates.

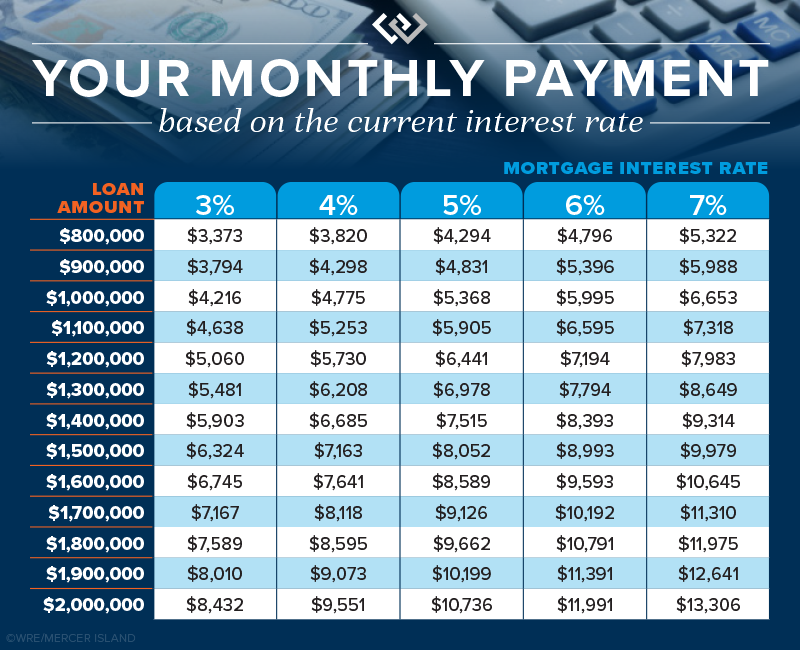

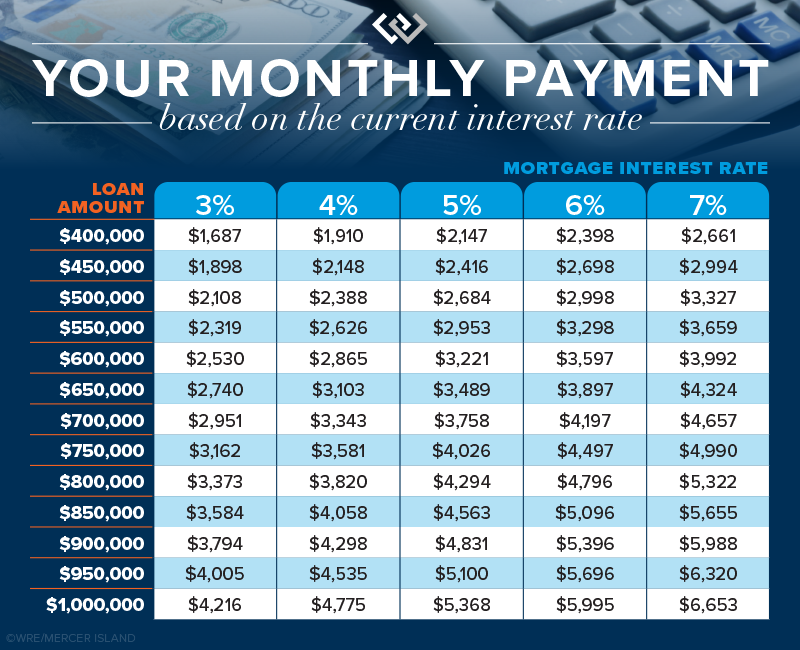

This second chart below shows how interest rates impact monthly payments. If you’re purchasing a $950,000 house at a 5% interest rate, you’ll be paying $596 less every month than if rates were 6%. That adds up quick…$7,152 in one year alone!

Job and Location Stability: Like nearly any investment vehicle, being able to buy and sell on your own time allows you take advantage of ideal market conditions or hold until a more favorable market returns. In an uncertain market, you should plan to be able to stay put for a minimum of 5-7 years if needed. If relocation or job loss is a distinct possibility, waiting to buy might avoid loss as a result of an untimely sale.

Homeownership Lifestyle: For many, homeownership represents a life accomplishment, independence, and financial security. For others, one more thing requiring maintenance and upkeep. Knowing where you stand (at this moment in time anyway) when it comes to evaluating the pros and cons of homeownership as a lifestyle choice is a better first step than an afterthought.

Final Thoughts

Want to know how you can best protect yourself in a changing real estate market? Reach out to us for help evaluating whether it would make financial sense to buy now or wait.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2022, Windermere Real Estate/Mercer Island.

Interest rates make a BIG difference when you buy…

You probably know that interest rates affect your monthly mortgage payments, but most of us aren’t aware of just how big an impact they really have on a home loan. Each 1% change in interest rate equates to roughly a 10% change in buying power. This means you can qualify for a much more expensive home when rates are low, whereas higher rates mean you qualify for less home—even though you still pay the same monthly payment.

This first chart shows how much house you can buy for a set monthly payment. If you have $4,000 a month to budget for a house payment (before taxes and insurance), you could purchase a $949,000 house at today’s historically low 3% mortgage rate. If rates went up to 4%, the same monthly payment would only get you an $838,000 home. Your buying power diminishes considerably with each bump up in rates.

Scrolling down, this second chart shows how interest rates impact monthly payments. If you’re purchasing a $950,000 house at today’s 3% interest rate, you’ll be paying $530 less every month than if you’d bought that same house when rates were 4%. That adds up quick…$6,360 in one year alone! This explains why so many renters are eagerly looking to buy right now, and why homeowners are refinancing at record rates.

Want to know how you can best take advantage of these historical low mortgage rates? Reach out to me for help evaluating whether it would make financial sense to refinance, buy, or sell while rates are low. I am always happy to be a resource!

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446 mercerisland@windermere.com

© Copyright 2020, Windermere Real Estate/Mercer Island.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link